Articles and News

2019 Holiday Is Luxury Jewelers’ Strongest Ever, But Not Because Of Millennials | January 01, 2020 (0 comments)

Merrick, NY—Something to smile about indeed! More than 80% of jewelers--the most ever--told The Centurion’s Holiday Sales Success Index survey that sales increased for the 2019 season over the 2018 holiday season. These results far outpace every Centurion holiday survey since 2012, including the upbeat results of 2018, when 60% of respondents reported year-on-year gains. The last time almost as many jewelers reported a blockbuster season was in 2013, when 77% of respondents to the Sales Success Index survey that year said their holiday season sales were up over the prior year.

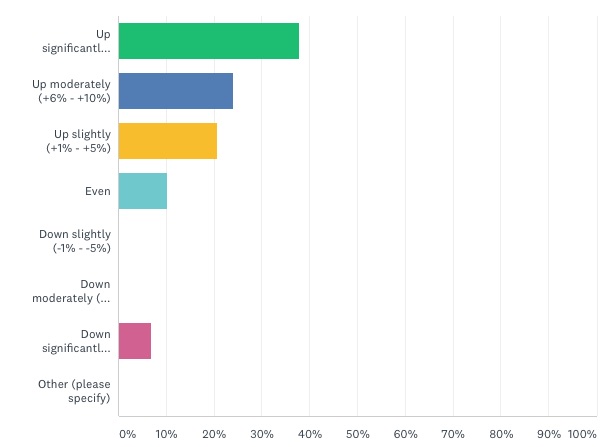

In 2019, 38% of respondents increased their sales by more than 10% over last year. 11% of respondents reported sales on par with last year, and only 7.4% reported a decline, compared with more than one-third of last year’s respondents.

But there was one glaring note of concern: the sales gains this year did not come from Millennial shoppers.

Related: Luxury Jewelers Outpace General Holiday Spending By 2:1

Upscale jewelers again greatly outpaced both general retail holiday spending and the rest of the jewelry industry. According to Mastercard SpendingPulse, which provides insights into overall retail spending trends (across all payment types, not just its own card), holiday retail sales for 2019, ex auto, grew 3.4% over 2018 for the two-month period from November 1 to December 24. SpendingPulse also reported a 1.8% growth in total retail sales across the entire jewelry sector. Online sales growth in the jewelry category grew 8.8% year-on-year, something Mastercard says began before the peak holiday season but helped to power the season through to a strong finish.

But compare that to the 62% of Centurion respondents reporting sales gains of at least 6% (and the 38% that grew 10% or more over last year and the high-end jewelry sector has reason to smile, as it led the jewelry category by far.

How Was Business For The Entire 2019 Holiday Season, Compared To Your Holiday Business Last Year?

The 3.4% growth in total holiday retail sales is well below the 5.6% growth recorded by SpendingPulse last year, and it’s slightly off the predictions made in October by the National Retail Federation. NRF was anticipating about a 4% jump in holiday sales for 2019, with a probability spread between 3.8% to 4.2%. Other analysts’ forecasts were more optimistic, ranging from 4.4% to 5.3%. Only analytics firm Coresight’s more modest estimate, between 3.5% and 4%, came close to the final figures.

But critical to note is that in all retail categories, e-commerce rocketed. Online sales across the board grew 18.8% over 2018.

“E-commerce sales hit a record high this year with more people doing their holiday shopping online,” said Steve Sadove, senior advisor for Mastercard and former CEO and chairman of Saks Inc. “Due to a later than usual Thanksgiving holiday, we saw retailers offering omnichannel sales earlier in the season, meeting consumers’ demand for the best deals across all channels and devices.”

Some results from other categories Mastercard SpendingPulse studied:

- Apparel, +1%

- Department stores, -1.8%

- Electronics and appliances, +4.6 percent

- Furniture and home furnishings, +1.3 percent.

While the best-performing price points for better jewelers this season were between $1,500 and $5,000, 27% of Centurion respondents reported their biggest holiday season sale topped $100,000. That’s fewer than the 40% who logged six-figure sales last year, but 65% of 2019 respondents reported their biggest sale was a five-digit ticket, a 15% increase over the 50% who said so last year. Almost half of the five-ticket sales were over $30,000. 29% were between $20,000 and $30,000, and 17.6% were between $10,000 and $20,000, and 12% were over $90,000.

This year’s biggest reported sale also was more than double last year’s: $750,000 vs. slightly over $300,000.

Big brand and product sales winners this season were both usual suspects—diamonds and Rolex—but also Gabriel & Co. and custom or private label pieces. Estate jewelry and pre-owned luxury watches also were strong performers. Other standout brands for the season were Hearts On Fire, David Yurman, Roberto Coin, and Mikimoto.

When asked “To what do you attribute any major uptick (or falloff) in business for the total year,” jewelers’ responses were evenly distributed between a strong economy and much better marketing or merchandising on their part, as well as quite a few that said “wish I knew!” Among those whose sales declined, most named specific causes ranging from losing a popular brand to losing a superstar salesperson.

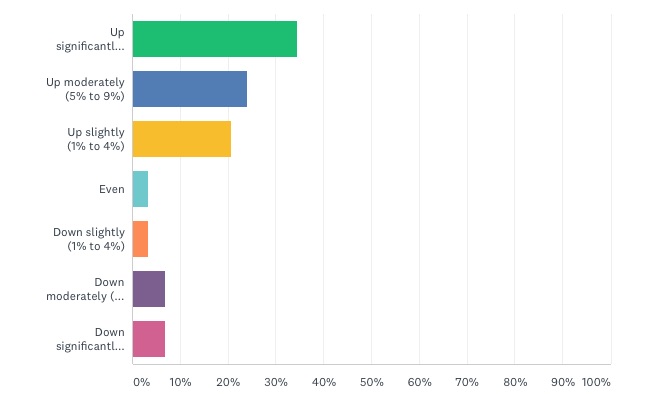

For the 2019 year in total, luxury jewelers should be happy. 78% of Centurion’s respondents finished the year up overall, a slight increase over the 70% that reported a good year last year. 33% were up more than 10% year-on-year, compared to 37% who reported those kinds of gains in 2018. 22% were up between 6% and 10% (compared to 27% last year) but another 22% were up between 1% and 4% for the whole of 2019, compared to only 6% who edged up for the total year in 2018.

How Would You Rate Your Total Year Business For 2019, Compared To 2018?

Finally, the alarming finding in The Centurion’s survey this year: despite recent studies to the contrary, better jewelers are still having trouble attracting Millennials. Last year’s survey showed it’s a problem, but it’s noticeably worse this year.

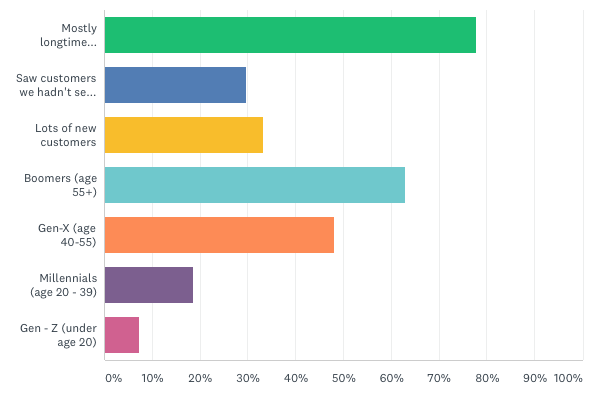

When asked to describe the demographics of their customers this season, 78% of Centurion respondents said most were longtime customers and a worrisome 63% said they were over age 55. Only 18% said a majority of customers this season were Millennials, compared to 25% last year.

Who Were The Majority Of Your Customers This Season?

Gen-X customers (age 40-50) stayed consistent with last year; about half of respondents reported this demographic as a major contributor to sales.

There were two bright spots: about one-third of respondents saw a lot of new customers this year, and about 7% of respondents reported Gen-Z is starting to shop for fine jewelry. This demographic didn't register at all in the 2018 survey. (Note: Respondents were allowed to check multiple options, hence totals add up to more than 100%.)