Articles and News

De Beers: Millennials And Gen Z Now Drive 2/3 Of Diamond Demand | September 17, 2018 (0 comments)

London, UK—The generational tide has officially turned, at least insofar as diamond jewelry is concerned. Millennials and their younger siblings, Gen-Z, accounted for two-thirds of global diamond jewelry sales in 2017—and global diamond jewelry demand reached a new record high of US $82 billion.

With these two digitally native generations now in the driver’s seat, the crossover between physical and digital retailing has melded together and resulted in a market that’s truly “phygitial.”

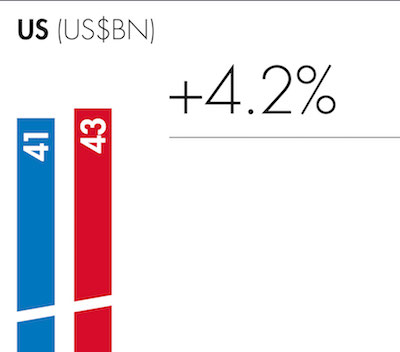

In the United States, diamond demand rose 4.2%, to $43 billion, in 2017. The United States accounts for more than half of global diamond demand, and was the main driver of global diamond growth. De Beers attributes this to the strong U.S. economy and late-year tax cuts last year.

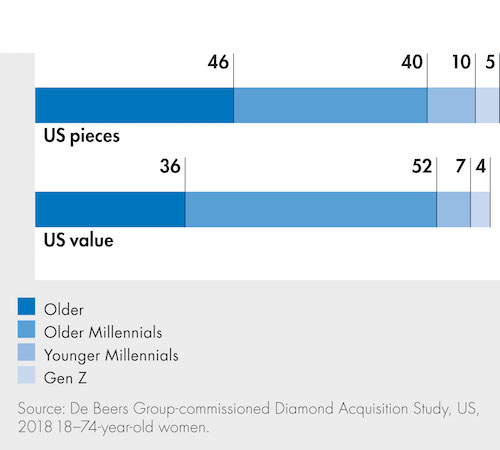

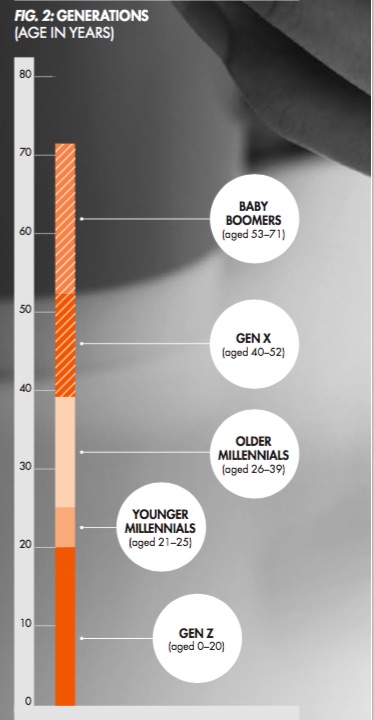

Millennials (currently ages 21 to 39) comprise 29% of the world’s population and almost 60% of diamond jewelry demand in the United States in 2017. They’re now largest group of diamond consumers. Gen Z, now teens through age 20, is an even larger consumer generation, representing 35% of the world’s population. Although still years away from financial wealth, Gen-Z already acquired 5% of all diamond jewelry pieces in the United States last year.

Above: a breakout of diamond consumption by U.S. consumers: Millennials have overtaken both Gen-X and Boomers as the primary purchaser of diamonds. By units (top bar), older and younger Millennials together equal 50% of the market, while older consumers (X'ers and Boomers) comprise only 46%. The difference by value (bottom bar) is even more stark. Gen-Z, currently age 20 and under, is already accounting for 5% of unit sales and 4% of market value.

Below: a refresher on the main diamond consumer cohorts living today. (Many members of the Silent (also called Traditionalist) Generation, born 1925-1945, also are living today, as are a few members of the GI Generation, born up to 1924, but they're not counted among those most likely to purchase diamonds.)

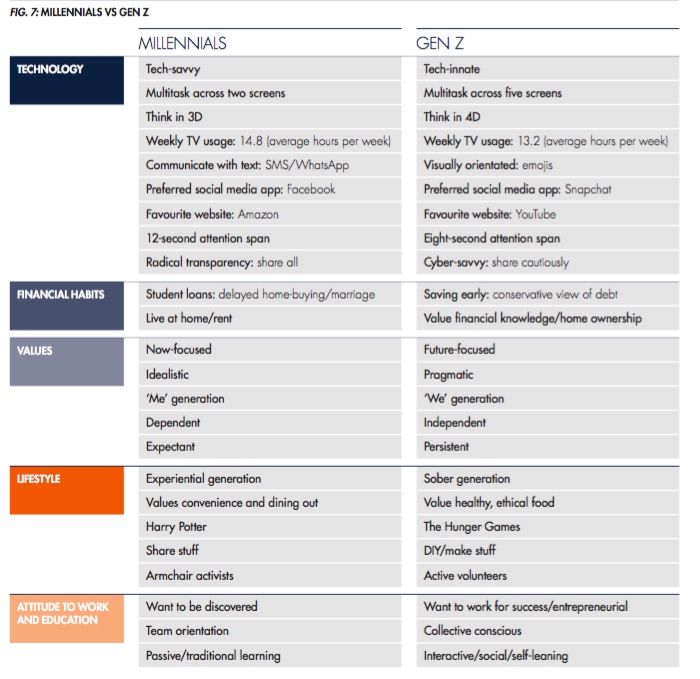

Millennials and Gen Z have some key similarities—and differences—as a result of their life experiences. The differences have important implications for diamond brands and retailers: for example, Millennials tend to be more mistrusting, requiring brands to earn their trust, while Gen Z tends to be more individualistic and optimistic, desiring products that help build their own “personal brands.”

Related: New And Surprising Intelligence About Women, Millennials, and Diamonds

Source: De Beers Diamond Insight Report

There are important similarities between the two generations, especially when it comes to valuing love, being digital natives, being engaged with social issues, and desiring authenticity and self-expression. De Beers’ report highlights three key areas of opportunity that the two younger generations present for the diamond industry:

Opportunity 1: Gifts of love, but on new terms. Romantic love remains the key driver globally for diamond jewelry sales, with both Millennials and Gen Z aspiring to committed relationships. But their attitudes toward how they express and symbolize love are evolving. For instance, while many Millennials and Gen Z still want to follow tradition and marry, many don’t.

The bridal market continues to be of central importance, (about 27% of diamond jewelry demand in the main diamond consuming countries), but diamonds given simply as a gift of love or romance unrelated to marriage drives a significant share of demand from younger consumers, representing 12% of total demand in 2017.

Action plan: Diamond brands and retailers must complement traditional designs with more niche, customizable offerings to reflect the broader interpretation of love and commitment from young consumers. Familial love is becoming a more important aspect of the diamond gifting market.

Opportunity 2: Tailoring communications, messages, and media to the natural behavior and preferences of Millennials and Gen Z.

Millennials and Gen Z are both digital communication natives, with an “always on” attitude. They also want instant gratification. Online shopping and social media are as significant to these generations as physical retail outlets when it comes to researching purchases, hence the “phygitial” market.

The majority (60%) of U.S. Millennial and Gen-Z women search the Internet prior to purchasing a diamond. But as all Millennials and Gen Z experience this seamless ‘phygital’ coexistence in their everyday lives, they expect an equally seamless experience when buying products.

Action plan: Omnichannel strategies that are organic, authentic, humorous, and use out-of-the-box thinking resonate most with these consumers, but retailers need to understand the different channels they favor.

Younger Millennials and Gen Z are more likely than older Millennials to look on social media for inspiration. Gen Z’s most popular social media platforms are Instagram and Snapchat, while Facebook, Twitter, and Pinterest are considered “older generations’ media” and of relatively less interest to Gen Z.

Opportunity 3: Aligning with social commitments is a priority for Millennial and Gen Z

Both generations display strong concern for social causes and responsibly sourced products. What you do and how you do it is just as important as what you sell and how you sell it. Paying lip service to “doing good” simply isn’t good enough.

Action plan: This highlights the opportunity for diamond brands and retailers to be more proactive in communicating the good that diamonds do throughout the world, and the contribution their individual brands make to important social causes.

Gen Z find corporate storytelling insufficient to meet their expectations, and expect brands to be able to back up their ethical claims, moving from ‘tell me’ to ‘show me’ when it comes to ethical sourcing. This makes technologies such as blockchain, that can provide digital asset tracking, more important.

Related: Borsheims Profiled On ‘Diamonds Do Good’ Website

Bruce Cleaver, De Beers Group CEO, said, “The younger generations present wide-ranging opportunities for the diamond industry, with the significant size and purchasing power of today’s Millennials and tomorrow’s Gen Z consumers. While both of these generations desire diamonds just as much as the generations that have come before them, there are undoubtedly new dynamics at play: those diamonds may now be in different product designs, used to symbolize new expressions of love, and researched and purchased in different ways to mark different moments in life.”

Key Diamond Consumer Trends in the United States:

- Average retail prices of diamond jewelry increased, primarily driven by higher demand for design-intensive pieces.

- Female self-purchase of diamond jewelry continued to rise, particularly among younger women. Female self-purchase (both married and single) accounted for one-third of all diamond jewelry pieces acquired in 2017. The average spend rose to levels spent on gifted pieces.

- Single women increased their average spend on diamond jewelry, buying more pieces with multiple diamonds and a higher total carat weight.

- The average price of diamond jewelry pieces bought online increased significantly, mainly due to omnichannel purchasing.

- The outlook for 2018 remains positive, with growth likely to remain steady.

Next week: A deeper look at De Beers' bridal market research.