Articles and News

The U.S. Jewelry Market Is Much Smaller Than You Think | September 05, 2018 (5 comments)

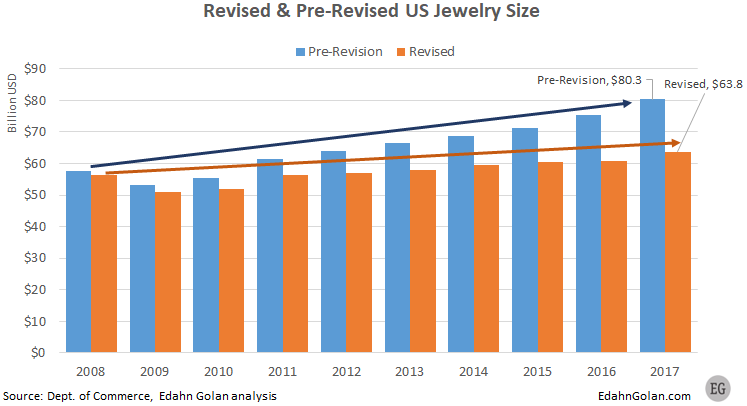

Merrick, NY--Anyone who has ever done a back-of-the-envelope calculation of the U.S. fine jewelry market in the past few years has arrived at figures far below the official numbers published by the US government. The differences were so wide that the government figures were downright puzzling. Recently, the U.S. government revised 10 years of market estimates, dating all the way back to January 2008--and shaving off more than $16.5 billion in jewelry sales in 2017 alone.

There is no need to be surprised at the revision, or by this radical reduction. The U.S. government revises its jewelry figures every few years, usually downwards. The last time it did so was in 2015. But unlike the 2015 revision, this one was far-reaching. There is no point being shocked by the old figures for being so out of whack. We have been stating that for a few years. In fact, the current figures are still somewhat inflated.

Why Is This Important?

Knowing the true size of the market has great importance for the industry. It impacts bank lending, manufacturers’ planning and even assessments of investments in the industry. Therefore, tracking these figures, understanding what they represent, and having confidence in their accuracy is central to understanding the business.

For example, most people believe that the jewelry sales figure represents only fine jewelry sales, but in fact it is jewelry in general. Both high-end diamond jewelry and $4.99 silver earrings set with CZ are counted in these figures, as well as pewter figurines. So to understand the jewelry figures, remember that even if all sales are counted correctly, we still need to apply a certain discount.

How and Why This Happened

There are a number of ways to calculate the size of the U.S. retail jewelry market. If you are the U.S. government, the easiest would be to start collecting sales figures of public specialty jewelry retailers such as Tiffany, Sterling (the US arm of Signet) and Blue Nile, and by measuring sales of privately held retailers, which all report their sales to--you guessed it--the government.

Next, it should have collected jewelry sales from the rest of the market: department stores, discounters, online retailers, et cetera. This is not easy. I know because I have done it myself (check out National Jeweler’s State of the Majors for some of my estimates), but the U.S. government has great resources that should make this task a lot easier.

So how did the U.S. government get it so wrong?

Simply by not measuring sales. Instead, it estimates local jewelry manufacturing, adds some import data to it, runs the figures through a calculation, and presto! It gets the wrong numbers. Worse, it adds several additional components that only throw off the figures even more.

Over the years, I have spoken more than once with the government agency that puts out these figures (the Department of Commerce’s Bureau of Economic Analysis). They were kind enough to share with me their methodology and discuss it, but were steadfast that they have it right.

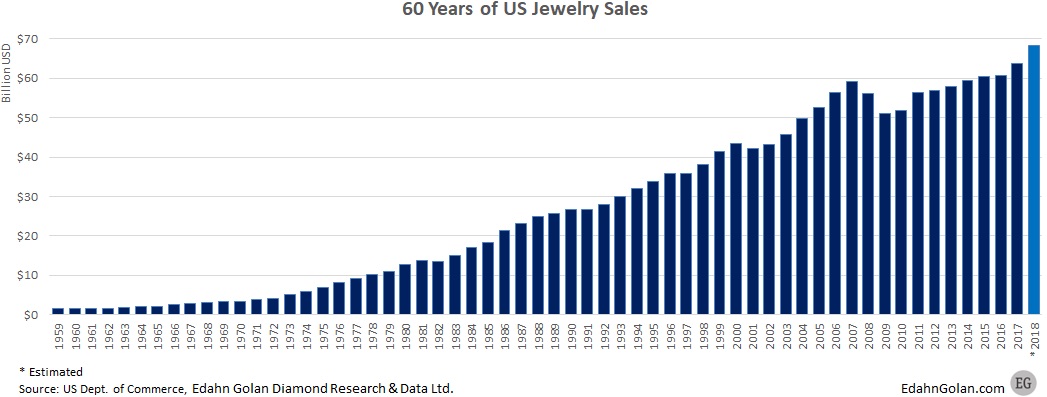

Between 1961 and 1980, jewelry sales growth averaged 11.3% per annum. In the last 18 years, jewelry sales growth dropped to just 2.5% per annum. This is an alarming trend.

As wrong as the jewelry sales figures are, even more disturbing are the watch sales numbers. For years, watch sales have declined worldwide as well as in the United States, until they started rising again in 2017. According to the government data, prior and post-revision, watch sales have only increased since 2009. Although the revised figures show a decline in growth, we still know them to be wrong. Just look at Swatch’s sales figures in the past decade to get a good sense of what has happened in that industry.

The New Official Size of the U.S. Jewelry Market

The revised figures are still high: according to the latest government figures, fine jewelry retail sales in 2017 were $63.8 billion, 20.6% less than the previously reported $80.3 billion in jewelry sales.

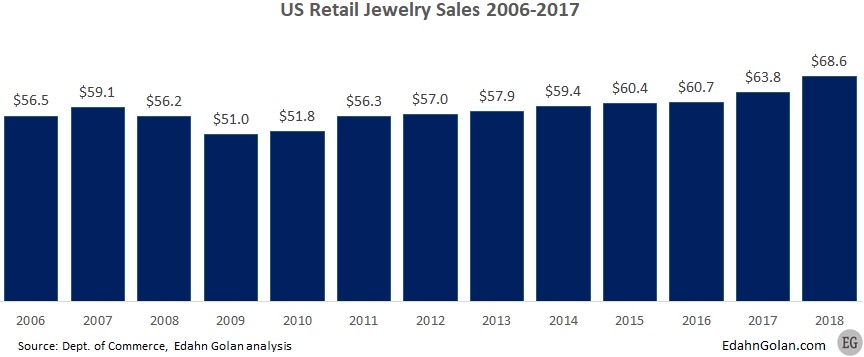

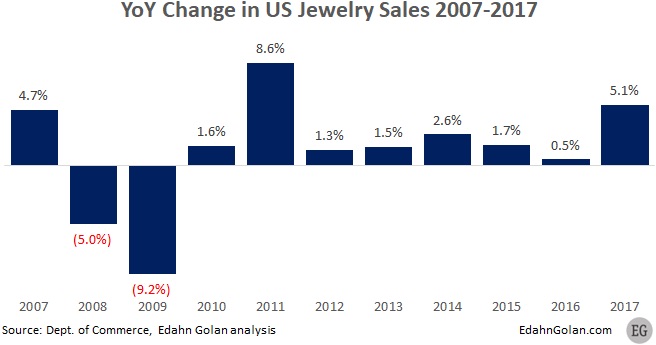

The good news is that, according to the revised data, the U.S. market for jewelry has increased steadily since 2009, after the Lehman Brothers financial crash. The increase in sales is measured, which we know is true. Year-over-year, jewelry sales have increased 5.1% in 2017. This is less than the previously reported 6.8%, but closer to what most retailers will report.

One of the problems with the U.S. government data over the years was that there was a sense that not only did it not accurately reflect the true size of the market, but that the size of the error was growing over the years. This is another point the revision addresses. The growth pace of the revised data is clearly more modest. In 2008, the difference is $1.3 billion, or 2.4% of the revised figures, growing to a monstrous $16.53 billion, or 25.9% of the revised figures.

Another finding of the revised data has to do with the rate of recovery from the 2008 financial meltdown. According to the previous figures, it took less than three years for jewelry sales to recoup. The revised data shows that only in 2014, seven years later, did jewelry sales catch up with pre-crisis values. Again, this more closely matches what retailers have reported.

An alarming finding is the change in the jewelry sales growth rate over the years. Based on the updated data, between 1961 and 1980, jewelry sales growth averaged 11.3% per annum. During the following 20 years (1981-2000), the growth rate averaged 6.4% per annum. However, in the last 18 years, jewelry sales growth dropped to an average of just 2.5% per annum.

This 43% drop in the average growth rate during the 1980s and ‘90s, followed by a 60% dive in the last 18 years would give any industry a nosebleed and is the reason why so many businesses are closing. Jewelry sales are losing share of wallet, meaning that consumers’ purchases of jewelry represent a declining percentage of their total expenditures. Clearly, the jewelry market needs to wake up to this realization and do something about it.

2018 Jewelry Sales

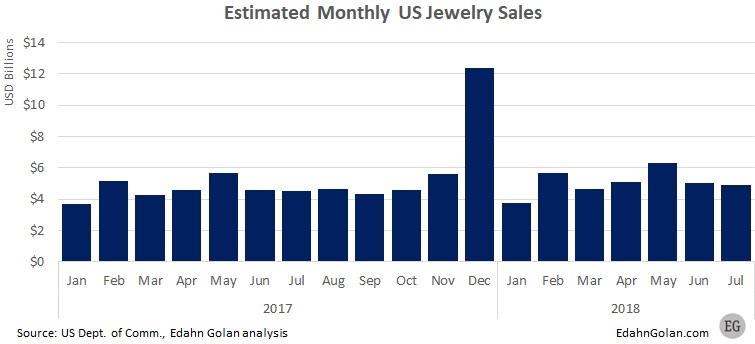

In the first half of 2018, jewelry sales in the United States totaled $30.5 billion, according to government estimates. It forecasts total 2018 jewelry sales at a little more than $68 billion, a 7% year-over-year growth. However, if there is anything we can conclude from these government figures over the years, it's that sales will in fact be lower and the rate of growth more moderate.

In July 2018, jewelry sales rose to an estimated $4.8 billion, according to the latest government data. Once again, this figure should be taken with a grain of salt. It represents an 8.7% year-over-year increase on an annualized basis.

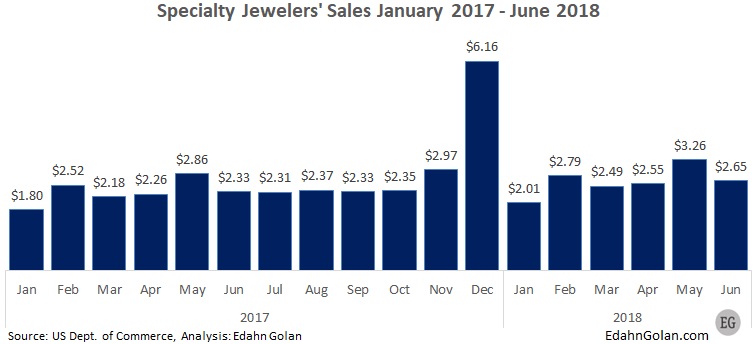

Specialty Jewelers’ Sales

During the first half of 2018, sales by specialty jewelers totaled $15.74 billion, according to the U.S. Census Bureau, another government agency tracking retail sales. This data was also recently revised, although just the last two-and-a-half years. According to it, sales have increased 13% during the period compared to January-June 2017. As with the total U.S. jewelry sales, expect these figures to be revised in the future.

Specialty Jewelers’ Market Share

The sales data the U.S. government reports covers all jewelry sales in the country: those made by specialty jewelry retailers, as well as by all other retailers such as department stores, online retailers, discounters, and retail clubs. Therefore, the restated jewelry sales figures also call attention to specialty jewelry retailers’ market share.

Based on the old government figures, specialty jewelers' market share fell below 50%. Post revision, specialty jewelry retailers’ market share is now restated at 50.8%, a figure that better reflects the market. If you compare sales by the largest U.S. specialty jewelry retailers to jewelry and watch sales by the rest of the market, you will find that the former has held a market share of about 52-54% for the past few years.

Based on the old government figures, specialty jewelers' market share fell below 50%. Post revision, specialty jewelry retailers’ market share is now restated at 50.8%, a figure that better reflects the market. If you compare sales by the largest U.S. specialty jewelry retailers to jewelry and watch sales by the rest of the market, you will find that the former has held a market share of about 52-54% for the past few years.

This may seem like good news for this sector, but a wider examination reveals that the general trend of an ongoing shrinking market share for all specialty jewelers (not just the largest and better performing ones) is still there: in the last five years, specialty jewelry retailers lost 2.9% of their market share. It is not inconceivable that they will fall below 50% in the next few years.

Takeaways:

The U.S. government uses an odd system to estimate retail jewelry sales, which leads to inflated results. Over the years, their error between real and reported sales tends to grow. The revised jewelry figures more accurately reflect real sales figures (but not the true watch sales figures).

Our own view of the US retail jewelry market is that it is going through a transitory stage. While this is always true, the current changes are greater than we have seen in over a decade:

- Many smaller independents are closing in favor of larger chains (consolidation),

- After a period of improvement, specialty jewelers are losing market share again,

- Desire for diamonds is slowing down,

- Limited spend on marketing is leading to ongoing erosion in consumer demand,

- Expenditure on jewelry is suffering from decreased share of wallet,

- Differentiation in design is badly needed; however, many smaller companies don’t adjust to changes in consumer interests,

- The market is slow to respond to consumers’ increasing desire for provenance and ethical sourcing,

- Many companies in the industry – retailers, manufacturers, and other stakeholders – have yet to adopt modern analysis tools. They are operating in near darkness, making important decisions based on limited information. That needs to change if we expect to restore growth and profitability figures seen until the 1980s.

With all this in mind, some retailers are adjusting to the changes, but not all of them, including most specialty retailers. Those that know how to adapt will do far better than the rest. Therefore, access to modern data analysis, understanding of consumer taste shifts, segmenting consumers more accurately, and managing daily store operations more accurately will allow these retailers to serve consumers better. When that happens, the kind of market growth seen in other industries will be seen in the jewelry industry as well.

Edahn Golan is an analyst advising financial institutions, global diamond firms, diamond industry organizations and governmental agencies on topics ranging from provenance of fancy color diamonds to the diamond’s contribution to local economies. Among his clients are diamond firms, miners, and the world’s second largest retail metrics firm. He has been quoted as an expert about the diamond sector and diamonds in The New York Times, the Wall Street Journal, and many other leading business and news publications. Click here to access his website, www.edahngolan.com