Articles and News

Tiffany, Sterling Turnarounds Are Progressing Well, Say CEOs | September 05, 2018 (0 comments)

New York, NY—Are Tiffany & Co. and Sterling finally turning things around? Both jewelers’ CEOs seem to think so, according to their most recent earnings calls.

Tiffany posted 12% worldwide sales growth for the second quarter, and CEO Alessandro Bogliolo says it’s an auspicious start to his plans to turn the moribund jeweler around. Bogliolo might just be the charm that Tiffany needs: he joined the jeweler in 2017 from Italian fashion brand Diesel, but brings experience in both beauty as former North American COO of Sephora, and in luxury jewelry as a former executive at Bvlgari.

Related: Signet, Tiffany Hope To Turn Tide With New Leadership

Good news here: spending in the Americas was driven by local traffic, rather than tourism. Jewelry collections sales rose 18% in the second quarter, driven by the popularity of the T, Victoria, Keys, and Return To Tiffany collections. Sales in the designer jewelry category (Elsa Peretti, Paloma Picasso, and Jean Schlumberger) also were up 5% in the quarter, and watch sales were up as well.

In Tiffany’s earnings call (read the full transcript here), Bogliolo gave some highlights from the six key strategic priorities he established:

1. Amplify an evolved brand message with an increased marketing spend across a range of media. Spending for the remainder of the year is planned well above prior year levels, with a whimsical holiday campaign planned. Bogliolo also said the “Believe In Dreams” campaign is a modern interpretation of Tiffany’s historical legacy.

2. Renew product offerings. Initial results of its new platinum and diamond Paper Flowers collection, launched in May, is filling an important need in the jeweler’s assortment, said Bogliolo. A new engagement jewelry [ring] called “Tiffany True” is slated for release soon.

3. Personalized jewelry. The new “Make It My Tiffany” program allows customers to create one-of-a-kind designs that can be engraved on jewelry and charms. It’s offered as an immediate in-store service in the New York flagship and 100 other stores globally, and it was the focus of a pop-up store near London’s Covent Garden. The individuality initiative is resonating very well with consumers, said Bogliolo.

4. Digital upgrades and pop-up online stores in China, as well as global display enhancements in all its North American stores by November.

5. A complete renovation of the famed New York flagship store on Fifth Avenue at 57th Street. The store, perhaps one of the most iconic retail destinations in the world, hasn’t been updated in more than a decade. Bogliolo promises much more than a facelift; he says this renovation will be nothing short of a transformation to create an environment second to none. Construction will begin in spring 2019 and is expected to be complete in Q4 2021; during construction the retail operations will be housed in back-end space and in the former Niketown space next door.

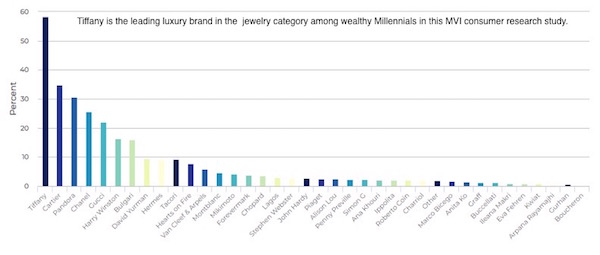

Despite its recent woes, Tiffany is in a good place to execute a turnaround. A study conducted late last year by MVI Marketing showed the brand to be one of the top classic luxury brands desired by wealthy U.S. Millennials.

Related: Wealthy Millennials Favor Heritage Luxury Brands In Jewelry And Watches, Says New Study

MVI’s study showed that Rolex, Jimmy Choo, and Tiffany showed the strongest leadership positions in their respective categories of watches, shoes, and jewelry. Cartier took the number-two spot for fine jewelry, with Pandora ranked third, followed by Gucci and Chanel (both fashion brands with fine jewelry offerings) tied for fourth place. Rounding out the top 10 in descending order were Harry Winston, Bvlgari, David Yurman, Hermes (another multi-category brand), Tacori, and Hearts On Fire. Although some of the rankings shifted with income, Tiffany remained number-one across all categories.

Chart: MVI Marketing

Separately, Sterling CEO Gina Drosos told investors that early signs show its Path to Brilliance transformation plan is working. (Read the full transcript here.)

“We are in the initial stages of a multi-year journey to invest in growth under our three strategic pillars of customer first, omni-channel and culture of agility and efficiency, which are enabled by driving out costs customers do not see or care about,” she said.

Gina Drosos

Total company same-store sales were up 1.7% in the second quarter, with North American store comps up 2%. Sales results reflected growth at the Zales, Piercing Pagoda, and JamesAllen.com divisions (Sterling’s parent company Signet acquired the online retailer JamesAllen.com in 2017) and improved performance in the Jared, Kay, Ernest Jones, and H. Samuel banners. E-commerce especially was up, with all banners showing growth in the high teens and James Allen up 25% year-on-year.

Drosos announced include plans to open a James Allen concept store this fall in Washington, DC. Fourth quarter advertising plans will differentiate more between the various brand banners than prior years, and will include integrations with college and pro football and basketball.

The company completed transitioning to an outsourced credit structure, and is on track to close more than 200 stores in fiscal 2019. This will allow it to focus on its core business of selling jewelry, and new store openings are focused on off-mall locations and desirable markets.

An employee survey showed efforts to revitalize the corporate culture—reeling from numerous sexual harassment and gender discrimination suits—is working.

“It is incredibly important at Signet that we create a workplace experience and culture that will allow us to continue to attract, retain and advance great people,” Drosos said. “We recently fielded our first employee survey in eight years and I'm pleased to report that our overall engagement levels outperformed retail benchmarks with particular strength in our field operations teams. Team members like the work they do, enjoy strong relationships with their immediate managers, and importantly believe they have a responsibility to promote diversity in the workplace.”

Finally, Drosos said that while no Signet stores currently carry lab-grown diamonds, they’re monitoring customer interest in the category and the company will be “well positioned to “participate in that space if the growth and the economics of it are attractive and if customers point us in that direction.”