Articles and News

Wealthy Millennials Favor Heritage Luxury Brands In Jewelry And Watches, Says New Study | November 29, 2017 (0 comments)

Austin, TX—Despite assertions that Millennials are not interested in traditional luxury brands, at least some classic luxury brands are highly desired among the growing segment of wealthy U.S. Millennials.

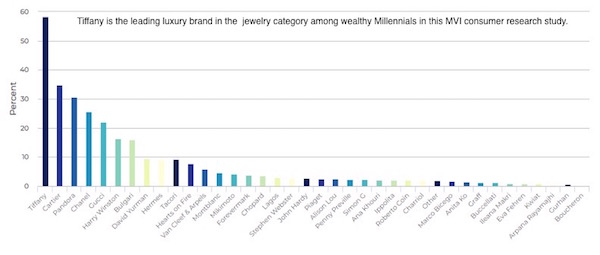

A consumer research study conducted this month by MVI Marketing LLC (MVI) found that Rolex, Jimmy Choo, and Tiffany show the strongest leadership positions in their respective product categories (watches, shoes, and jewelry, respectively.) Product categories researched for the study included fashion (apparel), shoes, handbags, jewelry, watches, hotels, automobiles, and eyewear. For the jewelry category overall, Tiffany took the number-one spot and Cartier number two. Accessible-luxury bead brand Pandora was ranked third, followed by Chanel and Gucci, both fashion brands with a fine jewelry component. Harry Winston, Bvlgari, David Yurman, Hermès, Tacori, and Hearts On Fire rounded up the top 10 (including a relative tie between Yurman and Hermès.)

As income levels rose, however, Pandora slipped in the rankings. Among respondents with incomes $150,000-$199,999, Chanel and Cartier tied for second place and Pandora tied Harry Winston for third place. Among respondents with incomes over $200,000, Gucci, Bvlgari and Chanel tied for number two, and Hermès was number three. Pandora tied with Cartier for fourth place. Tiffany remained solidly number-one at all income levels.

Total jewelry brand rankings in MVI's luxury study.

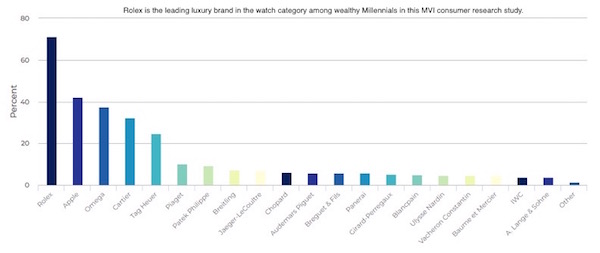

For watches, the number-one desired brand overall was Rolex, by a wide margin. Number two was Apple, followed in order by Omega, Cartier, Tag Heuer, Piaget, Patek Philippe, Breitling, Jaeger-LeCoultre, and Chopard to round out the top 10.

Like the jewelry category, some shifting of preferences took place at different income levels. Among respondents in the $150,000 to $199,999 income group, the top five favored brands were, in descending order, Rolex, Cartier, Omega, Apple, Tag Heuer. Among respondents with $200,000 or more in annual income, the top five in descending order were Rolex, Apple, Omega, Cartier, and Tag Heuer.

Total watch brand rankings in MVI's luxury study.

Accessible/entry luxury brands, however, topped the lists for both apparel and handbags, where the top three preferred brands were Coach, Michael Kors, and Kate Spade. In the hotel category, the top spot went to Ritz-Carlton, but the number-two brand was J.W. Marriott, another in the “entry luxury” category.

MVI’s Marty Hurwitz believes the appeal of Marriott stems from the brand’s robust social media and content marketing strategy, a critical element in marketing to Millennials.

“Marriott has a lot of engaging videos about travel that consumers can relate to and latch onto. If you just do a search on YouTube for Marriott videos, it’s just incredible. They’ve become a production house for getting consumers engaged with the brand without trying to sell them anything. The fact that J.W. Marriott ranked so high is a result of that,” he said.

Very few jewelry brands are doing enough of this, Hurwitz told The Centurion. “Tiffany is doing it a little bit and watches [brands] are doing it a little bit but overall jewelry really is not.” He believes that what Tiffany is doing in that regard, however, is what’s helping to push the brand to the number-one spot among affluent Millennials.

Marketing to this cohort—on the cusp of a 30-year period of affluence and spending—is an entirely different animal than marketing to Boomers, and Hurwitz believes the jewelry industry overall has not caught onto the difference yet.

Content marketing is a major part of it, he says. While he says brands have the best opportunity to do content marketing on a national basis, it can be extremely effective for independent jewelers as well. “There are independents like R.F. Moeller that are doing it and that’s great, but we need more of it on a regular schedule. If an independent can do that and keep track of customers it can be very effective. If there’s some sort of combination with brands it could be even more powerful.”

Hurwitz also suggests independents just jump in and try it. “The interesting thing is that it doesn’t have to be slick Madison Avenue stuff,” he says. “Consumers are very interested in artisanal videos that look very authentic, almost amateurish. It’s more likely to get their attention. I think that’s very powerful and very genuine.”

MVI conducted its research online from November 20-22, 2017. There were 978 respondents, both male and female, from 25-40 years of age and with $80,000 household income and higher. The study asked wealthy Millennial-age male and female consumers in the USA to pick their luxury brand favorites in key product categories, said Liz Chatelain, president of MVI.

“While some categories had clear outlier favorites, the majority including fashion, handbags, automobiles, hotels, and eyewear are all white spaces looking for brand leadership. It’s a significant opportunity for brands to penetrate this growing wealthy consumer segment that will drive purchasing power for the next 30 years.”

The study did not address either price or purchase channel; i.e. are the famously bargain-savvy Millennials going to buy at full-price or look for gray market or other off-price options?

“This is a benchmark study trying to get a handle on this new wealth consumer segment. It’s a toe in the water for us but we have follow-up studies coming down road,” said Hurwitz. He also pointed out that Millennial affluence tends to be more prevalent along the coasts. There are pockets of high-earning Millennials inland, just not as many.

The research study and report, titled Luxury Brand Favorites of Millennials, is the launch for MVI’s new LuxConsumer research service, assisting luxury brands to better understand and communicate with younger luxury consumers.