Articles and News

Top Global Economist Says “The Sun Is Back Out, Go Make Hay!” | April 01, 2015 (0 comments)

Wilkes Barre, PA—We’re starting to feel “normal” again. For the first time since the middle of the last decade, real GDP growth is anticipated to be 3% for both 2015 and 2016.

That’s not a new post-recession normal, either, says Jay Bryson, managing director and global economist for Wells Fargo Securities. That’s an old-fashioned, before-the-recession normal: the U.S. GDP grew 3% annually from 1992 through 2007.

Speaking to the Greater Scranton and Greater Wilkes Barre (PA) Chambers of Commerce, Bryson said there’s no recession in the forecast. Indeed, some charts may even understate the strength of the U.S. economy.

Part of the reason for the renewed growth in the economy is real government purchases, he said. While government spending is a political hot button, the lack of government spending has been a real headwind against economic growth.

“It’s not just Washington DC,” he told the audience of primarily small business owners. “The Feds are responsible for about 50%, but state and local governments are responsible for the other 50%.” Cutbacks by state and local governments were the first drag on the economy for the last five years; the Federal government, particularly the 2013 sequester, were the second drag on economic growth.

Now that revenues are up at the state and local levels and purse strings are loosening, the economy is benefiting. The private sector, meanwhile, is experiencing steady 5% to 6% growth, which he says is typical for this part of an economic cycle.

Dr. Jay Bryson, global economist for Wells Fargo.

Two-thirds of the U.S. economy is driven by consumer spending. That’s ramped up in recent quarters, and is expected to remain solid, says Bryson. He cited the most encouraging tailwinds on the economy:

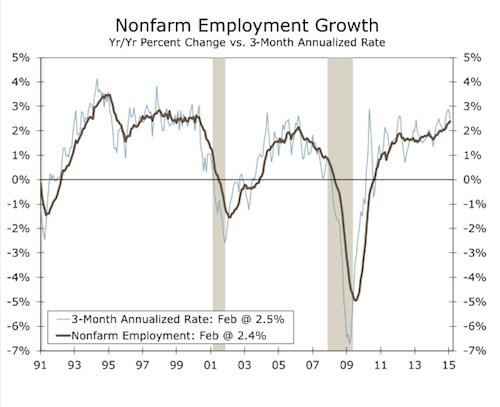

1. Employment growth is up 2-1/2%. The last time it grew this much was in the 1990s—until recently, the last time we saw 3 million jobs created was in 1999. Employment growth creates income growth, which in turn impacts consumer spending.

2. Household debt deleveraging is nearing its final stages. U.S. per-capita net worth has returned to its previous highs, and people feel better as the holes in their balance sheets close. Savings rates always go up in a recession; this time they stayed elevated even after the recession was over. Now they’re beginning to come down, but in a good way—people are still adding to their savings, just not quite as fast and frugal as before. As an example, Bryson cited auto sales, which at 17 million are already equal to 2007. “It could jump to 18 or 19 million,” he added.

3. Crude oil production is up in the United States. Five years ago, the United States produced five million barrels of oil a day; now it’s up to nine million. While current low oil prices aren’t good news for states like North Dakota, Oklahoma, and others in the Oil Patch, declining gas prices are providing a real boost to consumers, especially low-income Americans.

“Gas prices don’t affect high-income consumers very much, but for low-income consumers it’s like getting a 4% gain in income,” said Bryson. Last year, gasoline accounted for 12% of a low-income family’s budget; this year it will consume only 8% of the budget. That frees up money to be spent in other places.

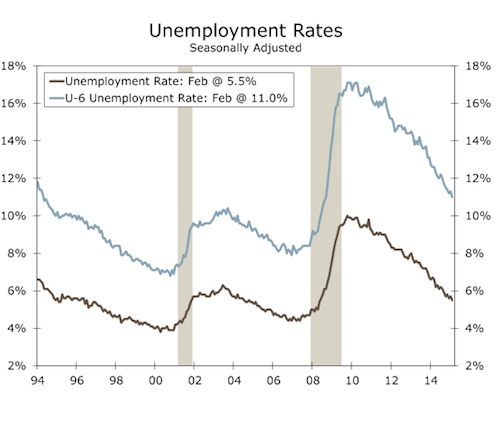

4. Unemployment is coming down. The measured rate is 5-1/2% but the “real” rate—the U6 measurement that takes into account people who have stopped looking or are underemployed, also is coming down. It stands at 11% but is declining and in fact possibly faster than measured.

The unemployment (brown line) is coming down and stands below 5%, but more importantly, the U-6 unemployment rate (blue line) which measures those who are underemployed or who have given up looking for work also is coming down. Source: Wells Fargo Securities and U.S. Department of Labor.

We’re also seeing some modest wage acceleration, said Bryson. It’s not 2004-2005, but there is some improvement as the labor market gets tighter.

Job growth is everywhere. U.S. manufacturing has added between 700,000 and 800,000 jobs since 2008. Construction jobs are up and services are up, especially in the financial sector and, contrary to popular belief, the service job growth isn’t all part-time menial labor. Fulltime service jobs in finance, education, and healthcare are growing. Those are all considered service-sector jobs, and they all are higher-level jobs that require an education.

“This isn’t our parents’ world. It’s all about education. There’s no assembly line [job growth],” Bryson said.

Job growth is up and continues to rise in manufacturing, construction, and services. But the jobs that are growing require education and/or skilled labor--there's no return to the assembly-line economy of the 1950s and 1960s. Source: Wells Fargo Securities and U.S. Department of Labor

Even the Affordable Care Act hasn’t had the kind of economic impact that politicians decried. “We did an exhaustive study—taking politics entirely out of it and just looking at numbers—to see if companies really were pushing employees to less than 30 hours to avoid having to pay health care. On a high level, there’s no conclusive evidence they are,” said Bryson. On a small level, it has happened, but even in some industries where you’d expect it to happen, such as restaurants, it hasn’t happened that much.

Bryson cautioned there still are some factors that could drag on economic growth:

1. Net exports aren’t growing as fast as imports. It’s not a huge difference—down ½%—but it’s there.

2. Growth in the Eurozone is weak. It may strengthen but it’s still not normal.

3. China isn’t likely to return to double-digit growth. It might flirt with it, but it won’t be sustained. Part of the slowdown isn’t a bad thing, says Bryson; it’s policy-induced to prevent bubbles. A good factor is that debt in China is mainly confined to real estate, construction, and the business sector; it’s not government debt. The Chinese government has very low debt and therefore could re-capitalize its banking system in the event of a crisis.

“The landing in China could be bumpy but it won’t be Lehman Brothers,” he said. And even if it did, it wouldn’t affect U.S. banking. In fact, the United States has very low exposure to the rest of the world in general, another great positive for our economy.

“How much does the rest of the world [economy] impact U.S. spending on healthcare? Zero. Education? Also zero. Construction? Near zero. It’ll affect Caterpillar and any other companies that export but it won’t impact construction here,” he said. Core inflation is expected to remain steady. Interest rates will go up, but slowly, predicts Bryson. He estimates September as the time frame for rates to go up. Why September? Oddly, it’s just because that’s when the Fed will hold a press conference.

“If you’re going to hike rates for the first time in nine years, you want to do it with a press conference,” said Bryson.

Contrary to popular belief, increased interest rates won’t kill the economy. 75% of consumer debt is mortgage debt, which is a fixed rate, he said. Also contrary to popular belief, the federal debt isn’t a drag on the economy, either. The debt to GDP ratio is stable, which is the number that matters most. The money is there to pay the debt. By way of comparison, Bryson said that if a business is a billion dollars in debt, you have to ask what the business is before hitting the panic button.

“If it’s a local business, that’s bad. If it’s Exxon Mobil, it’s no big deal.” In fact, a zero federal deficit will drag the economy down, not boost it up. And as we’ve seen, when the economy is slow, tax revenues slow, and it doubles down again.

“So what things could trip us up?” asked Bryson. The biggest are things are largely global and beyond our control. An escalation of the Russia/Ukraine situation, a war, anything that sharply drives up oil, and so forth.

“In the seven years since 2008, this is the most optimistic I’ve felt about the economy,” Bryson told the audience. “It’s not 1999—yet—but it’s pretty good.” Business owners are feeling pretty good too, he said—confidence indices are up. “The sun is out. Make hay!” he concluded.

To watch an exclusive video interview with Dr. Bryson in which he addresses the indicators most relevant to luxury jewelers, click here.