Articles and News

How To Achieve Effective Cash Flow Management | April 11, 2011 (2 comments)

Riding the Cash Flow Tides

This is the first of a series of exclusive articles addressing cash flow and sound financial strategy, by the Vantage Group for The Centurion.

La Costa, CA--In the past few years, we have observed more than ever that a drain on cash flow is the most significant issue affecting business owners, including jewelers. It is hard to stay positive and motivated when cash flow fluctuates to a degree that feels unnerving. The recession, and the resulting changes in the economy—even as recovery begins—still has caused jewelers to reevaluate their businesses both for the long-term and the short-term with a more prudent eye.

Watching your business more closely and addressing areas of concern is important but it is crucial to recognize how many different aspects play into the health of a business. Fixing one or two areas of obvious concern in and of itself is rarely viable. The entire business must be addressed to ensure the business' long-term survival and growth.

Are you worried about being able to pay back your bank loan or paying your vendors in the agreed upon time? Or are you concerned about what your cash position will be this time next year? These are just a few of the kinds of questions that jewelers have asked us—usually when they are already worried. Over coming editions of The Centurion, we will address these issues in various articles. We also encourage readers to submit questions or topics of interest for us to address.

We have found that poor cash flow impedes good decision making, especially when there is not a monthly financial plan in place. Indeed, to go a step farther, research from the Small Business Administration indicates that poor planning is responsible for most business failures. Owners are more likely to make decisions based on what they can afford today, rather than what is to the long-term benefit of the business. Even worse is creating commitments to spend dollars that you hope to have at a later date.

Having a monthly cash flow plan that is regularly updated will provide the confidence to make astute financial decisions for the long-term health of the business. A major component of the operation of a store is having a cash flow that truly flows. Look at the lines that travel into and out of that reservoir we call finances. If you were to consider your cash flow as a body of water that over time you want to increase and watch the level rise, then you must consider what is flowing in and out. With each ebb and flow there is a change in that water level. It’s normal to expect high and low tides—but it’s important avoid an undertow whenever possible.

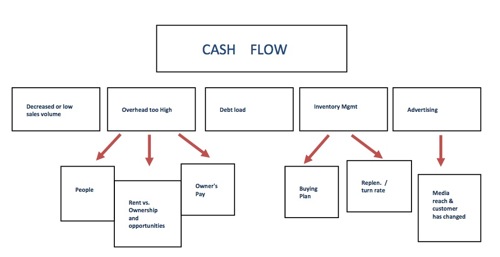

What causes the water (cash flow) level to rise? Positive inputs to your cash flow, such as increasing sales, lowering overhead, excellent inventory management, reducing debt load, and effective advertising, which in turn creates increased sales.

Conversely, the water level drops when there is a pull on any of the following: Decreased sales, excessive overhead, merchandise buying without a detailed plan, slow turn rate, not fully recouping the replacement cost of merchandise, high interest rates on loans, and ineffective advertising.

Another consideration is who your customer is today. The mix and education levels of customers coming in the store today may be different from who shopped with you several years ago. Although you want to stay true to yourself, you must move along with your customer. As the customer demographic changes, so must your business. As the economy has shifted, Baby Boomers have pulled back spending on luxury goods as many saw their retirement savings deplete in the market. Customer groups you should be targeting include the bridal customer, and Generation Y customers in general, who communicate differently, get their information differently, shop differently and receive advertising far differently than the Baby Boomers most luxury jewelers are used to serving. You must adjust not only your merchandise mix but also your advertising reach and methods as well, in order to be successful in the years ahead.

Good cash flow is the key to keeping your head above water and filling the reservoir to a level you feel comfortable dipping into. Over the next several months we will closely examine each of these, addressing key areas you may need to examine more closely to begin pushing that cash flow upward to a higher level. Ultimately it's up to you if you sink or swim.

Vantage Group understands success depends on how well all aspects of your organization work together. After decades of experience with both national retailers as well as independent chains, Dan and Lori Askew apply their expertise to assisting the independent retailer and manufacturers in the jewelry industry. They closely examine each area and address them in the order that will make the greatest impact in the most time efficient way on your business. They are committed to partnering with owners to grow their businesses incrementally while avoiding many of the pitfalls that may exist along the way. What sets Vantage Group apart from other consulting groups is the broad base of expertise. The commitment is to insure your overall success through cash flow, merchandise planning, inventory control, advertising, and store management by partnering with you from the beginning or joining you at any point along the way.