Sales Strategy

New Survey Shows Younger Consumers—And Men—Love Pearls | August 25, 2021 (1 comment)

New York, NY—Not your grandmother’s pearls indeed! A new comprehensive consumer study focusing on pearls and pearl jewelry revealed that younger consumers—age 25-35—are particularly interested in pearls and consider them to be a top gem to give, receive, and purchase for themselves. Image: CPAA

Especially noteworthy was the acceptance of men wearing pearls: 37% of male respondents said they have and would wear pearls themselves, particularly men ages 25-45.

Also noteworthy was the number of consumers who would consider a pearl engagement ring: 28% of jewelry consumers say “yes” and 43% “maybe” to considering pearl as a center gem for an engagement ring. The youngest demographic, ages 25-35, is on board: 36% responded “yes” and 40% “maybe,” possibly influenced by recent celebrity engagements—Ariana Grande, Emma Stone, and Michelle Williams—celebrated with pearl rings.

Related: Ariana Grande’s Engagement Ring Shows How Traditional And Non-Traditional Work Together

The study was a joint effort between the Cultured Pearl Association of America (CPAA) and MVI Marketing LLC (THE MVEye), a market research and strategic consulting firm serving the jewelry industry. The Benchmark Study of Consumer Preferences for Pearls is the first major U.S. consumer study focusing on cultured pearls, and will serve as a benchmark for future market research.

The objective of the study was to identify consumer shopping and buying patterns related to cultured pearls and pearl jewelry and ascertain differences among various demographics to identify opportunities for the pearl industry. The survey was deployed July 19–24, 2021, and was completed by 1,012 U.S. jewelry consumers who purchased at least $200 of fine jewelry in the past three years. Respondents were ages 25–55, 73% female and 27% male, have household incomes greater than $50,000, are 27% single and 63% married, 10% engaged or getting engaged, and 73% white, 9% black/African American, 9% Asian, 6% LatinX.

Here are some key findings from the study (all charts, CPAA/MVI):

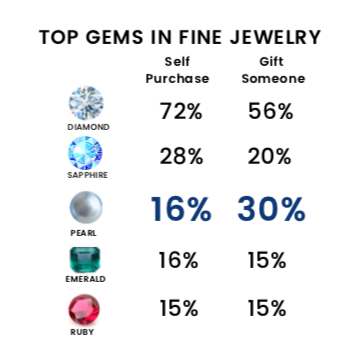

- After diamond, consumers ranked sapphire as the second-most likely purchase (either gift or self) and pearls were third, ranking above both emerald and ruby.

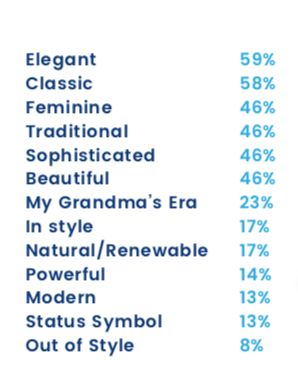

- Consumers were far more likely to associate pearls with attributes like elegance, classic, feminine, than “grandma” or “out of style.” But enough respondents (almost one-third) still link pearls to “grandma” or “out of style,” signaling that perception does need to be addressed, says the study. Here are the attributes and the number of respondents that checked each (respondents could check more than one).

- Design and style are the primary drivers of purchase for all respondents, with 58% of total respondents saying it’s the number-one consideration. Price comes in second, a key driver for 37% of consumers. But among affluent consumers (HHI >$200,000), design and style is even more important: it’s a primary motivator for 66%, while price impacts decision-making only for 19% of this demographic. They’re also more likely to consider what metals are used in the piece, and whether it has other gemstones.

- Affluent consumers are more likely to consider pearls, period. Among respondents with HHI above $100,000, 31% to 39% of consumers purchased or received pearls, compared to 24%-27% with household incomes below $100,000.

- Almost one-third (32%) of respondents with income over $200,000 have spent at least $3,000 on pearls in the past two years. Age-wise, between 43% and 48% of consumers age 25-44 spent at least $3,000 on pearls in the past two years.

- Two-thirds of all respondents (66%) own at least one pearl jewel. Of those, 69% own a strand, 62% pearl earrings (respondents could check more than one item.)

- 65% of pearl jewelry owners have at least one family heirloom among their pearl pieces.

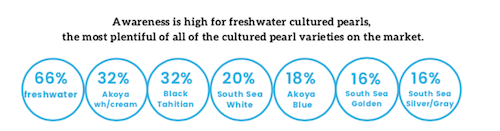

- Awareness is highest for cultured freshwater pearls.

- The top three outlets for purchasing pearls were chain jewelry stores (47%), independent jewelry stores (42%), and high-end jewelry stores (28%). Editor’s note: the survey did not indicate whether the “high-end” category was predominantly independent stores; assuming they were, that bumps the total purchase incidence at independent, non-chain jewelers up to 70%.

- Younger consumers were more likely to purchase pearls from a chain jewelry store than older consumers. 50% of respondents age 25-45 shopped at a chain jeweler, compared to 40% of 46-55 year olds. The oldest respondents were most likely (53%) to shop at an independent jewelry store.

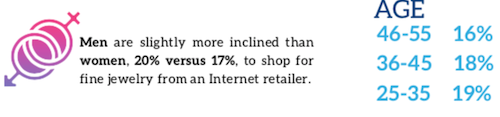

- All consumers surveyed shop for jewelry online as well. Men were slightly more likely than women to shop online, and younger consumers more likely than older consumers. The top three sites for fine jewelry shopping were Amazon (48%), Etsy (20%) and Blue Nile (16%).

- 52% of consumers who have purchased or received pearl jewelry in the past three years say that is was for a birthday, 46% for an anniversary.

- Sustainability is a good sales story: while the survey reveals high awareness of cultured pearls, with 81% of consumers having heard the term, only 34% know what it means and 60% were unaware that pearls are sustainable. The story of responsibly cultured pearls is one of a renewable resource that not only contributes to the health of the marine environment, but also helps to sustain families in remote communities.

The study concludes that jewelers and the pearl trade do not have to sell consumers on the idea of cultured pearls because they already like, have, and desire them. Product investment, good promotion, and good sales presentations are what will show consumers what makes pearls the perfect gift to give, receive, and buy for oneself.