Articles and News

2020 Gold Demand Sinks To 11-Year Low February 02, 2021 (0 comments)

London, UK—Data released from the World Gold Council last week shows gold demand in the fourth quarter of 2020 fell to its lowest level since the 2008 financial crisis. The coronavirus pandemic of course was the driving factor behind weakness in consumer demand, and the metal’s record high prices proved to be a mixed blessing. Image: Statista.com

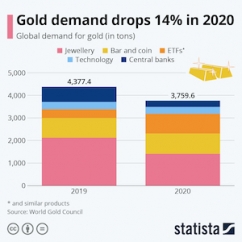

Fourth-quarter gold demand worldwide was 28% lower year-on-year than the same period in 2019, and full-year figures show the gold market shrank by about 14% off 2019. By volume, annual demand for 2020 was 3,759.6 tonnes, the first year since 2009 to register an annual demand below 4,000t.

Demand from central banks fell 59%, jewelry demand dropped 33%, and technology sector demand fell by 7%. The only positive sector was bar and coin demand, which rose 10% year-on-year in Q4 2020, pushing total annual retail investment up 3% to 896.1t—but still weak relative to the 10-year average of 1,199.5t.

Total annual gold supply also declined by 4% year-on-year, the largest annual fall since 2013. The drop was largely explained by coronavirus-related disruption to mine production, offset by a marginal 1% increase in recycling.

The coronavirus pandemic impacted gold supply as well as demand, says the World Gold Council.

Jewelry demand in 2020 dropped to its lowest annual level on record, decimated by the combination of the global pandemic and its resultant market lockdowns, coupled with record high gold prices at a time of economic slowdown. World Gold Council figures show:

- Total annual jewelry demand dropped to 1,411.6t, the lowest in WGC’s annual data series, and 34% lower year-on-year.

- At 515.9t, Q4 demand extended the sequential quarterly recovery from Q3, but was nonetheless 13% weaker year-on-year compared with an already relatively soft Q4 2019, and the lowest Q4 in WGC’s quarterly data series.

- The two largest markets, India and China, were the two major contributors to the annual decline and the Q4 improvement.

- Although jewelry demand showed continued signs of quarterly recovery from the lows reached in Q2 when market lockdowns were at their peak, it remained very weak in Q4. Global demand clambered back above 500 tonnes in Q4, but the final total of 515.9t is the lowest Q4 in WGC’s 21-year data series. On an annual basis, demand collapsed to 1,411.6t, a 34% drop from 2019.

- High prices meant the value measure of jewelry demand was far more resilient. In US dollars, demand in Q4 grew 11% to $31.1 billion, the highest quarterly value since Q2 2013. After a very weak first half in which jewelry demand fell to an 11-year low, the second half posted a sharp recovery and a rise of 3% year-on-year, mitigating some of the first half loss. The steep increase in the amount that consumers were prepared to spend on gold jewelry could be indicative of diverting expenditure away from experiences and towards consumer goods.

- While jewelry demand volumes are likely to remain relatively subdued as COVID-19 continues to impede the normal functioning of many markets across the globe, mass vaccination programs and signs of improving economic indicators imply that we expect to see continued, if tentative, improvement in the sector in 2021.

- Gold jewelry demand in the United States was 10% lower than 2019 for the full year, but Q4 demand was relatively robust, down just 1% from 2019, due to the release of some pent-up demand from earlier quarters and spending being diverted from travel and dining out. But in value terms, the U.S. picture is more positive, with high gold prices helping fuel a quarterly record of $2.9 billion.

- Gold demand in Europe dropped 21% in 2020.