Articles and News

Affluent Trump Supporters And Millennials Most Likely To Buy Jewelry, Says YouGov Study | June 21, 2017 (0 comments)

Cheshire, CT—With political rancor at an all-time high in the United States, affluent consumers are just as polarized as everyone else, according to findings from the YouGov Affluent Perspective 2017 Global Study. What is different is that their opinions—positive or negative—will noticeably impact luxury retailers.

Overall, affluent Americans will spend about $335 billion on luxury goods in 2017, a 1% increase over last year. The annual YouGov study, fielded in February and March, studies the attitudes, lifestyles, values, and shopping behaviors of affluent consumers, examining them by age, income, and planned expenditures in eight categories: fine watches and fine jewelry, women’s handbags, home décor and furnishings, electronics, fashion apparel, fashion accessories, fine dining, and leisure travel.

While experience categories (dining and travel) account for 50% of the overall spending total, Cara David, YouGov managing partner, says the data shows a marked increase in planned purchases of luxury products, owing to the growing population of affluent Millennials.

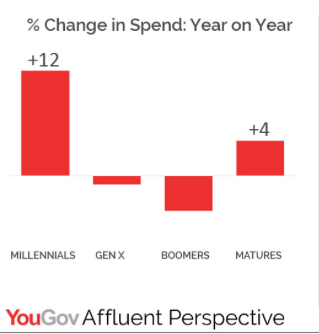

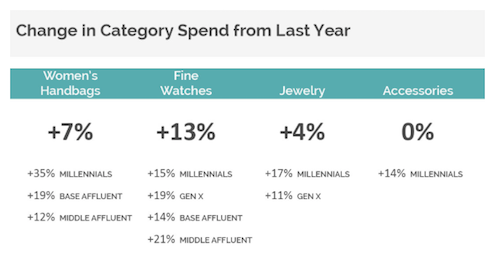

While Boomers and Gen-Xers still make up the bulk of affluent U.S. households (11.4 million) and do the lion’s share (67%) of the spending on luxury, Millennials (3.1 million households) plan to increase their spending on luxury by 12% this year, vs. Boomers who plan to decrease spending by 4% and Gen-Xers, who plan to decrease spending slightly (-1%). What’s more, Millennials are driving a 17% total increase in spending on jewelry and watches.

Source: YouGov Affluent Perspective 2017 Global Study, among U.S. Respondents

“Today’s affluent Millennials are the first generation to grow up primarily in affluent households. These wealthy youths have more experience with, and passion for, luxury brands than any previous age group — and this novel combination is causing rapid changes in their spending habits. Their purchase decisions, for instance, are largely based on their need to build a career, connect with the right network, and continue along an upwardly mobile path,” says David.

At the same time, affluent Boomers surveyed reported themselves content with what they own, focusing now on experiences and boosting their retirement nest eggs. Affluent Gen-Xers are still finding a balance between spending on their children and saving for retirement, but with some room for fun: they’re very likely to spend for experiences, but they want to enjoy those experiences while wearing a good watch and carrying a good bag, two categories where they indicate purchase intentions.

By income, YouGov identified three distinct groups of affluent consumers: Base affluent, with household income between $150K and $199.9K, comprise 50% of all affluent consumers. Middle affluent, with income between $200K and $349K, comprise 33% of the total affluent consumer base, and the ultra-affluent, with incomes over $350K, account for only 17% of the market. These figures jive with the findings of other experts, who say the sheer volume of entry-level affluent consumers in the aggregate far outpaces the greater individual spending power of the ultra-affluent.

Source: YouGov Affluent Perspective 2017 Global Study, among U.S. Respondents

Jewelers, meanwhile, might want to call up customers who support President Trump. YouGov’s research says affluent Trump supporters are far more likely (+175%) to buy jewelry than anyone else.

Overall, YouGov found 41% of affluent consumers approve, and 49% disapprove of how Donald Trump is handling the job of president. But his supporters are far more likely to increase spending on discretionary purchases this year than detractors, who are planning to funnel more discretionary income toward political causes.

While approval or disapproval of the president falls heavily along party lines, there is more crossover than one might think. YouGov’s Chandler Mount told The Centurion that while 77% of affluent Republicans approve of the job Trump is doing, 11% don’t. 81% of affluent Democrats disapprove of Trump, but 12% approve. The remaining respondents expressed no opinion either way. These proportions remain similar across all three levels of affluent income groups, Mount says.

In total, says Mount, 29% of affluent consumers identified as Republican and 35% as Democrat. But sorting your customers by political party won't yield much: Mount says the study shows affluent Republicans plan to spend just 1% more on jewelry than their affluent Democrat counterparts.

But affluent Trump fans—regardless of party—are projected to increase their luxury spending by 8% in 2017, while affluent Trump detractors will decrease their spending by 3%. YouGov estimates Trump supporters will spend 51% more on fashion, 95% more on home décor, and a whopping 175% more on jewelry than Trump detractors. In total, supporters are anticipated to spend 50% more on luxury than detractors this year, and they’re likely to do it in the store. Cara David says this means it’s essential for salespeople to put their personal political feelings aside and focus on making the sale (good advice in any situation).

Top image: The White House