Articles and News

Gold Should Be Rocketing Right Now. Why Isn’t It? | March 18, 2020 (2 comments)

Merrick, NY—It’s a common belief that when the stock market goes down or shows unusual volatility, gold prices go up as investors seek safe havens for their money.

By that principle, gold should be through the roof now. Indeed, gold shot up to over $1,700 an ounce on Monday, March 11, as the first of the week’s stock market dives occurred. But exactly one week later, also on Monday morning, gold had retreated to $1466, a three-month low. At press time, it was $1,510 an ounce.

Is this good news for the jewelry industry or not? It depends why.

In a letter to clients and friends last Thursday, Bruce Freshley, president of South Carolina-based Freshley Media, struck an optimistic note. “Crazy, right? The stock market drops almost 2000 points and gold goes down?

“Fear drives the stock market. Fear also drives the gold price. Gold is the final capitulation, when folks are truly afraid. You would think that money would be flocking to gold, but it’s not.”

In his note, Freshley expressed his belief that this is an indication of a stock market correction rather than a recession—yet—and that the gold price drop means that big money is flocking to snap up stocks to take advantage of depressed prices.

But that was last week, in a situation so fluid that it changes almost hourly. By Monday, experts in the financial markets were far less confident.

For one thing, gold prices and the stock market don’t have a long-term symbiotic relationship with each other.

“Markets are not logical in the short term, but emotional. Fear and greed are the main drivers behind any liquid asset in the short term, including gold and stocks,” Przemsylaw Radomski, CFA, founder, owner, and main editor of Sunshine Profits.com, a website offering information and professional support for precious metals investors, told The Centurion during the last run-up in gold prices.

To say that emotions are running high is an understatement, as more and more government officials force closures of schools and commercial establishments to try and stop the virus's spread.

And if there’s one thing financial markets especially hate, it’s uncertainty. Stock trading was halted again Monday morning for the third time in a week as the S&P 500 lost more than 7% at the opening bell. The Monday morning roundup on precious metals news site Kitco.com bore the ominous headline, “Gold, silver prices collapsing amid markets panic – ‘sell what you can’.” Platinum also fell 27% in Monday’s trading.

Explaining gold. Of the three major precious metals, gold has the highest percentage of investment to industrial use. Approximately 32% of gold is pure investment (including coins and bars as well as central banks and ETFs). Of the remaining 68% that goes to physical use, 52.4% is used for jewelry—which also is viewed as an investment in many cultures. Less than 17% of gold use is truly industrial, mainly in electronics. By contrast, only about 6% of platinum is investment and the rest is industrial (or jewelry) use, as reflected in its steep plunge. But if analysts expect a decline in physical use of gold to result from economic conditions, that will have an impact on its price as well.

Radomski also says prior gold price run-ups occurred under very different circumstances, and that “final capitulation,” like Freshley describes, is a relative term.

“Gold is an excellent hedge against major wars, financial crises, and hyperinflation,” he explained to The Centurion. “During war times, currencies might not be as good as a precious metal that used to be money for thousands of years. During financial crises and hyperinflation, gold helps to preserve one's purchasing power when things go south.”

What's happening right now is none of the above cases, he says. In a major global pandemic, gold's ultimate-store-of-wealth status won't help much.

“It's not a war; we don't have the need to use gold as money. It's not a financial crisis. There might be local liquidity shortages, but the Fed and other banks are standing ready to provide the liquidity as the need arises. It's not hyperinflation either.”

Finally, he says, gold ultimately needs human contact to fulfill its role as money. “You need to hand it over to someone (or receive it) to facilitate the trade. Right now, it's the last thing that is advised. Instead, electronic payments and credit cards (especially touchless technology) are much preferred. It's not a situation in which gold shines.”

How low will gold go? Nobody knows. Radomski says it’s likely to regain value quicker than stocks—people do want to have some hedge against the worst—but he also cautions it likely won't be immune to further major slides.

Quick bounce? Market analysts now believe a recession is inevitable—the only question is how bad it will be.

In a special report issued Monday, Wells Fargo’s acting chief economist Jay Bryson called a global downturn “imminent.” He, and most economists, agree the best-case scenario is that it will be sharp but short, a classic “V” style recession with declines in Q2 and Q3 and recovery beginning in Q4.

But agreement on what the best-case scenario is doesn’t guarantee it will happen that way. Bryson cautions that it all depends on how the virus situation progresses. If it’s contained and begins to decline quickly in the United States, the real GDP may not decline as much as feared, but if it accelerates well into the second quarter, the contraction could be worse than current projections. Allianz’s economist Mohamed El-Erian is already anticipating more of a “U” or “L” shape, with more time spent at lows before recovery begins.

“The trouble with economic sudden stops is it’s not easy to restart an economy,” he told CNBC’s “The Squawk Box” last week. Financial markets will bounce back first, then lead the economy into recovery, he says.

Gold isn’t the only index behaving unusually. This article said not only were stocks and bonds moving in tandem instead of their normal opposite last week, but that bonds and gold were unusual in falling at the same time and “all kinds of obscure markets went haywire.” And the efforts taken by the Federal Reserve on Sunday—intended to calm markets and prop up the economy—may have served to spook investors further.

“So what does this say about the future of our jewelry businesses?” asked Freshley. “What steps should we be taking as the entire economy seems wrapped up in corona fears, and justifiably so?”

Related: How To Survive Coronavirus, And We Don’t Mean Hand Sanitizer

At the time of Freshley's email, COVID-19 had had little effect on jewelers around the country that he spoke to. We also saw evidence of that in some jewelers’ social media posts, such as Chip Davis of Skaneateles Jewelry in upstate New York, who said both of his stores were doing solid business as of last week.

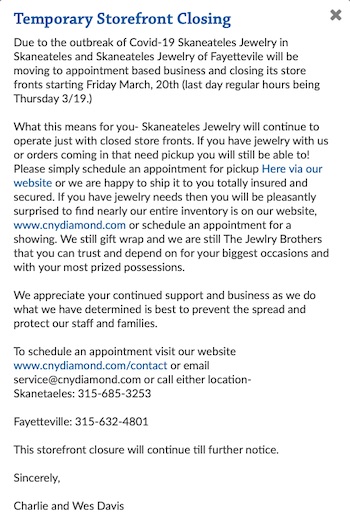

But that was last week. By press time, the jeweler announced all business moving to appointment basis:

What's next? Freshley suggests tracking Rolex sales for the rest of this month and next: a big drop in those sales, he feels, is a sure sign of a downturn. Meanwhile, Robin Givhan, fashion critic for The Washington Post, points out that while people’s clothes (and accessories) are an expression of who they are, with everything closed people are living in sweatpants and pajamas, and we don’t know how long it will be before they have reason to get dressed up again.

Based on what we do know, it’s clear that jewelers need to strategize for a year that’s going to look very different from what it started out to be. On Monday, even president Trump acknowledged the potential for recession and that it could be months before Americans’ life returns to a semblance of normalcy.

Longer term, a crisis can spur people toward clarity and purpose, says Freshley. This could provide a boost to bridal sales or significant anniversary purchases once the dust settles, but in the short term, CDC requests to postpone large gatherings such as weddings for the next eight weeks are understandably worrisome to jewelers.

Meanwhile, mass business closures are going to impact everyone, but if you can, paying your employees during a closure or while taking time off to care for an affected relative will generate immeasurable goodwill in your community and position you well for when people do feel like spending again, says industry analyst Russell Shor.