Articles and News

Holiday Shopping Behavior Study Reveals Interesting Insights December 16, 2020 (1 comment)

New York, NY—Online or in person? Mobile or desktop? Early or late? How are consumers shopping this year and what do retailers need to know? Image: Loquate

The 2020 Loquate Holiday Shopper Insights Report explores the behaviors, trends, and expectations of more than 1,200 U.S. consumers. Some key findings offer surprises, such as that mobile and desktop shopping are about equal, proving that while mobile is increasingly important, reports of the desktop’s demise are greatly exaggerated—and tablets aren’t a big player.

The study was conducted by Loquate location intelligence service, a division of UK-based GBG, a global identity data intelligence specialist with worldwide offices. Among its clients in the United States are companies such as Nordstrom, IBM, Ralph Lauren, Sephora, Kohl’s, and more.

Here are some notable findings from the report:

Mobile vs. desktop. Boomers (62%) are most likely to shop on a desktop, and Millennials (60%) are most likely to shop via mobile device. Among Gen-Xers, 50% are more inclined to shop on a mobile device, vs. 43% who plan to shop via desktop. 56% of Gen-Z shoppers will be on a mobile device, vs. 40% shopping from a desktop. Only 9% of consumers total plan to shop via tablet.

Chart: Loquate

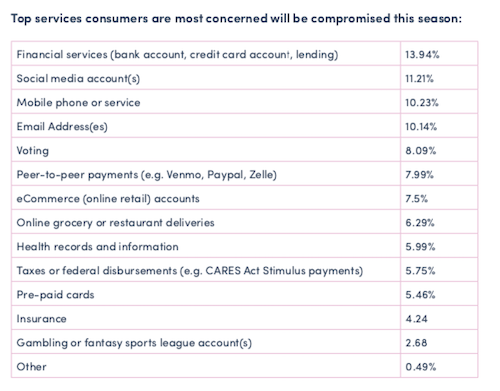

Fears of fraud. About half of respondents are worried about fraud of some kind. The most common concern is package theft: holidays are a prime time for porch pirates as well as shoppers, though this is a bigger concern for urban residents than rural.

Perhaps unexpectedly, Boomers are less concerned about fraud than their younger counterparts. Gen-X are the most concerned about online shopping fraud (45%) and Boomers (16%) the least. Gen-Z, meanwhile, are more concerned about social media fraud, something that about 11% each of Gen-X and Millennials also think about but Boomers don’t seem to.

After package theft, these are the kinds of fraud consumers are most worried about. Chart: Loquate

Whose shopping behavior changed most this year? Boomers'. While Millennials and Gen-Z have traditionally been the drivers of growing digital retail, the COVID-19 pandemic has driven a 65% increase in Boomers shopping online, says Loquate’s report, which referenced data from PayPal. A full two-thirds (67%) of shoppers age 55+ planned to take advantage of online shopping this season as a safer alternative to in-person. Prior to COVID, 82% of Boomers did less than 50% of their total shopping online, but post COVID, almost half (47%) plan to continue shopping online.

Loquate says, “This holiday season is a welcome opportunity for retailers to keep them online long term. But, some of these digital newbies may still require a gentle touch. Generation Zoom will benefit from a simple online experience. Make it easy for them with a well-designed UX (user experience) and an easy to navigate checkout page; many have higher spending power and more consistent, pension-based income.”

Best non-digital marketing strategy? Direct mail. Loquate says 84% of consumers purchased an item after seeing it in a catalog, and 51% of people who received direct mail from an e-retailer visited that retailer’s website.

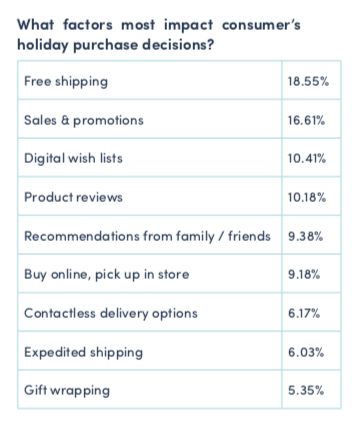

And some things never change: pandemic or not, free shipping remains one of the most important factors impacting consumers’ decision to hit the “buy” button or not.