Articles and News

It’s A Trend: Yet Another Retail Study Says Less Stuff, More Concern For Social Issues | July 10, 2019 (0 comments)

Chicago, IL—As Millennials overtake Boomers in number, retailers need to brace for a seismic shift, says The Future of Retail 2019, a study conducted earlier this year by Chicago-based Walker Sands Communications.

For Millennials, purchase decisions are mainly driven by convenience and connection: how easy is it to make the purchase, and how connected do they feel to the brand or retailer? Here’s the catch: it’s not just enough to be convenient; retailers and brands need to walk the walk on both sustainability and social issues. The Future of Retail 2019 says the youngest consumers are not only the most likely to say they’re buying less and living more minimalist lifestyles, they’re also the most likely to want brands to offer sustainability options and pay attention to their viewpoint.

It’s a Marie Kondo world, indeed. 66% of all consumers say they’re buying less than they used to because they’re more conscious of keeping a clean organized lifestyle, but that figure rises to 72% of consumers age 18-35. Contrast that with Boomers, who at the same age were in full-on acquisition mode and only recently have been more focused on shedding possessions than buying them.

Related: Luxury Consumers Are Burned Out. What’s A Jeweler To Do?

Some key findings from the Walker-Sands Future Of Retail 2019 study:

- 46% of consumers are more open than they were even a year ago to purchasing a big-ticket item like a car online.

- 32% of all consumers and 43% of Millennials 18-35 receive one or more Amazon packages per week. 10% of all consumers receive three or more Amazon packages per week.

- 55% of all consumers are at least somewhat more likely to make a purchase from a brand or retailer committed to sustainability—and that number jumps to 65% among consumers 18-35.

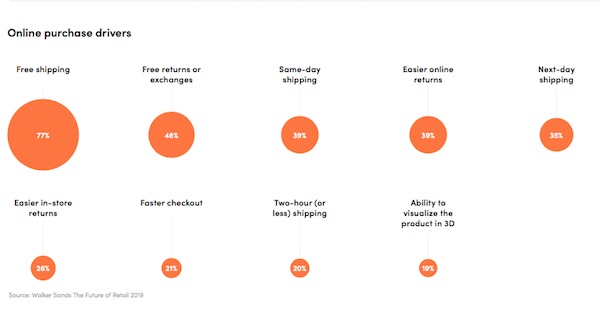

- Fast free shipping continues to be the number-one driver of online purchases, but one-fourth of consumers in the study said they feel more connected to a brand in-store.

Not surprisingly, Millennials are the most likely to own a connected home device, but consumers of all generations are adapting technology to their daily lives. A smartphone is the device most consumers are likely to own, regardless of age. Tablets, on the other hand, are more popular with older consumers than younger: 60% of consumers in the 36-45 and 46-60 age ranges own tablets, compared with 53% in the 18-25 group and 59% in the 26-35 group.

Interestingly, while consumers are concerned about privacy issues and data collection, fewer than 20% are creeped out enough to eschew having a voice-controlled digital home assistant (such as Alexa) or other connected appliances. 18% of consumers believe Alexa listens to everything, but they’re willing to trade off privacy for convenience, even though at this point only about 15% will tell Alexa to order more milk.

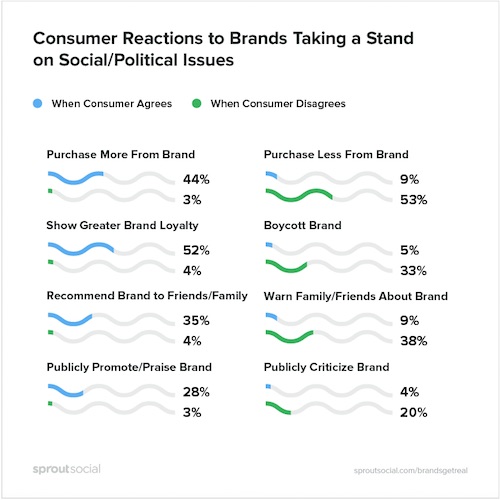

Politics? Get used to it. Staying away from politics and controversy used to be the default setting for both brands and retailers. After all, few want to lose half their customers in the blink of an eye. But a recent study from Sprout Social showed two-thirds of consumers today do expect brands they support to take a stand on political and social issues. The question for brands has moved from “should we?” to “when/how do we?” Brands are slightly more likely to be rewarded than punished for taking a stand, says Sprout (below): 28% of consumers will publicly praise a company whose values align with their own; 20% will publicly criticize a company whose values don’t align with their own.

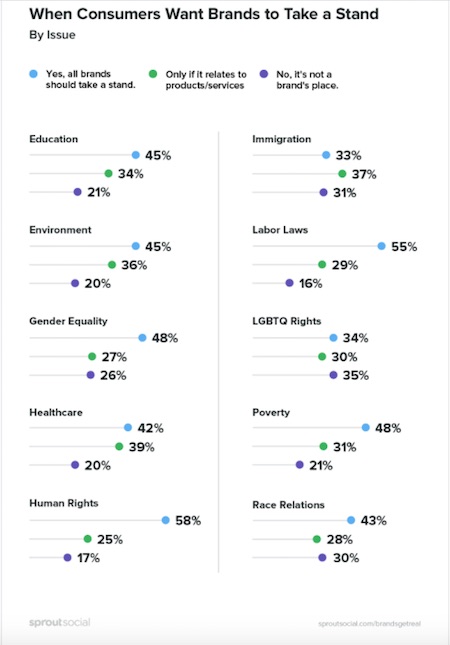

Consumers most often want brands to take a stance on two closely related topics, human rights and labor laws. Least often, immigration and LGBTQ issues. Overall, respondents that self-identified as liberal were far more likely to want brands to take a stand and reward them for doing so, compared to conservatives. On average, 80% of liberals said it matters, vs. an average of 49% of conservatives. But the key to taking a stand successfully is relevance and authenticity: is the brand or retailer sincere, or just hopping on the bandwagon?

This chart from Sprout Social shows the issues consumers think brands should or should not take a stance on.

The Walker Sands study backs up the importance of taking a stand. 68% of consumers age 18-35 said the current political climate “has impacted” their shopping in some way. More than 40% of all consumers say their awareness and concern about the social policies of brands has increased since Donald Trump’s election, and for younger consumers 18-35, that number rises to more than half (53%).

Although Sprout's research showed consumers don't feel strongly about having brands take a stance on immigration, the youngest consumers in the Walker Sands study (ages 18-25) do care about the topic. Supporting women-owned retailers and immigrant-owned retailers was important to these consumers, an indication that diversity and equality are likely to become a bigger purchase driver.

Finally, sustainability is the other issue you can’t avoid. Despite the onslaught of Amazon packages, consumers of all ages believe they’re buying less. This is especially true of younger consumers, who are taking to rentals and secondhand like a duck to water.

Related: More Key Millennial Intel: They Love Secondhand Goods

According to the Walker Sands study, the top rental categories for consumers ages 26-35 last year were, in descending order, books, cars/clothes and apparel (tied), furniture/household goods (tied), and vacation spots.

Curated “try and buy” services like StitchFix for clothing or BirchBox for cosmetics are on the rise, too. Presently, 8% of consumers have tried such a service but almost one third (31%) of respondents to the Walker Sands study say they’re at least somewhat likely to try one in the next 12 months.

These consumers also are putting manufacturing processes under more scrutiny, with 2/3 of respondents saying that they’re more likely to buy from a business that puts an emphasis on sustainablity.

Related: Doing Well By Doing Good Part II: Real Life Examples Retailers Can Use

Online comfort. As consumers grow more comfortable online, shopping for big-ticket items becomes more commonplace—and the biggest jump is in older consumers. 61% of consumers age 61+ said they’re more likely to purchase big-ticket items online compared to a year ago.

On average, slightly more than half of Millennials/younger Gen-X say they’re more likely to buy a big-ticket item online, while the group least likely to are those age 46-60.

While still a relatively small percentage of the total, the number of consumers who are browsing—and buying—high ticket items online is rising. Furniture (20%) and appliances (17%) are the most likely to be bought online, but 13% of respondents to the Future of Retail study bought a car online in the past year. 11% bought luxury clothing and 7% even bought a house online.

That said, however, the biggest drivers for online purchase still are no surprise: free shipping is number one (77%) and free returns is number two (48%). Pretty much everything else starts to be a nice-to-have, not a need-to-have.

Finally, good news for jewelers and other luxury merchants: a brick-and-mortar is still the preferred place to buy luxury items, says Walker Sands, and consumers significantly prefer a branded store to a one-stop shop. Preference for one-stop shopping tended to win out in lower-priced categories, whereas branded shopping dominated in the two high-ticket categories of furniture and luxury goods, suggesting that consumers still want the white glove treatment and that high-end retailers (in either category) also function as a brand apart from any brands they might carry in-store.

Luxury goods (middle of chart) are still more likely to be purchased in a physical store, says the Walker Sands Future of Retail 2019 study, which surveyed 1,600 consumers across the United States in March 2019.