Articles and News

Luxury Consumers Are Burned Out. What’s A Jeweler To Do? | June 26, 2019 (0 comments)

Merrick, NY—We are not in a “Marie Kondo moment.” We’re in a Marie Kondo world.

Kondo, the petite Japanese wunderkind of tidying up, advocates paring your possessions down to only those most essential items that “spark joy” in your life, and getting rid of everything else. While her philosophy has sparked an empire for herself (books and a Netflix TV series), filled up thrift stores around the country, and inspired jokes about ditching one’s vegetables and gym membership, the fact is Kondo didn’t start the trend, she just capitalized on a very real zeitgeist: people, especially affluent people, have enough.

Marie Kondo's "KonMari" method of paring down possessions has caught on with a consuming public overwhelmed by too much clutter and stuff. Image below: Good Housekeeping

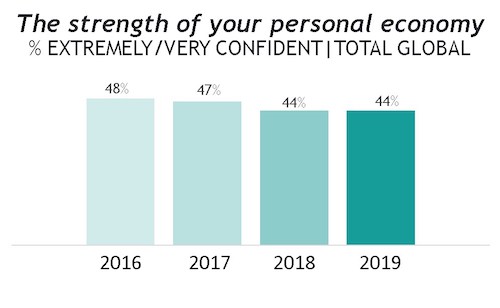

In the latest YouGov Affluent Perspective 2019 study, an annual pulse-check of the world’s affluent population, respondents generally feel good about their own financial situations—although slightly less so than a few years ago—and not so good about their respective country’s economies. But overall, most report themselves satisfied.

Affluent consumers aren't overly confident of the economy in general, though most feel secure personally. Chart: YouGov

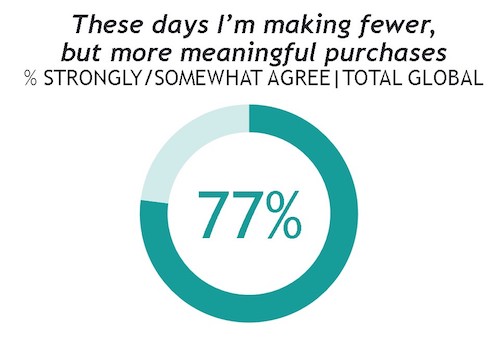

That’s the good news. The not-so-good news is that they’re also satisfied with the amount of luxury goods they own and they’re not overly inclined to buy more. 77% of total respondents said they’re making fewer, but more meaningful purchases of luxury goods.

That could be great news for jewelers—or not—depending on their definition of “meaningful.”

“These consumers have been consuming luxury for a long time and are seriously questioning how much more luxury they need in their lives,” Cara David, managing partner at YouGov and head of its Affluent Perspective team, said in an earlier interview. “They are suffering from burnout.”

YouGov will be conducting more research into what constitutes “meaningful” purchasing later this year, such as whether consumers see that strictly within the context of personal milestones, says spokesperson Kevin Sansone.

“But [for now] I can say that when we talk about meaningful purchasing, we talk about it in the context of purchasing goods and services that have a positive impact on humanity. So for some luxury consumers, it is about sustainable products, for others it is about purchasing from companies that treat employees well. Jewelry purchasing could absolutely fall into this category as some consumers may be cognizant of the sourcing of the materials,” he told The Centurion.

77% of affluent consumers surveyed by YouGov this spring say they're making fewer, but more meaningful, purchases. Chart: YouGov

Sustainable and ethical may make people feel better when they do purchase, but is it going to be enough to make them purchase?

Luxury marketing expert Pamela Danziger of Stevens, PA-based Unity Marketing, says we’re coming to the end of the consumer-driven culture that America has had since the end of WWII.

“People have been buying, upgrading, acquiring, and bringing in more and more stuff. We aren’t owning our homes, they’re owning us,” Danziger told The Centurion. “As Boomers are downsizing and downscaling, I think young people have awakened to the fact that the more you own, the more strings you have attached to you.”

Pamela Danziger, Unity Marketing

Diamond industry analyst Edahn Golan concurs. While the diamond sector has its own antiquated business model to blame for many of its current woes, it can't control a culture shift.

"The preference for experiences over objects is not the result of something that happened in a jewelry store. It’s a response to consumerism in general. It would seem that the smart retailer would take that into account when thinking about how to improve their relationships with their clients," he says. "Integrating product into experience is a good way to go. GoPro did it really well when they offered to raise the bar on extreme sports: by using their camera we can all have an 'extreme' experience.

"Note that they never talk about cameras in their ads. They talk sports, experiences, vacations, etc. That is what 'A Diamond Is Forever' did: spoke of love and family. Diamonds were just a way to symbolize it. That is why De Beers is so adamantly against the commoditization of diamonds--it kills the sell."

Diamond industry analyst Edahn Golan

YouGov’s survey—taken by more than 8,000 affluent consumers worldwide—shows the number-one thing affluent consumers value about their money is freedom. 60% of respondents said the most important thing about having money is the freedom it gives. The second-most important aspect, self-esteem, was 30 percentage points lower, showing just how important freedom is.

Related: Forevermark Announces Fall Ad Campaign

Golan also observes that branded diamonds fared better in the recent Las Vegas shows than unbranded goods, signifying the importance of provenance and quality, something Danziger hit on the nose in her observations as well.

“Sustainability is a real underlying motivation, particularly among younger people. They’re very concerned. They recognize what they consume and how they consume has a big impact on environment and it’s really playing out in the choices they make as consumers,” she said.

Related: Doing Well By Doing Good, Part II: Real Life Examples Retailers Can Use

In theory, luxury items should be better quality and last longer, reducing the need to buy so much and inspiring consumers to invest in a good piece that they’ll keep for a long time, she said. But that’s often simply not the case, says Danziger: a lot of luxury brands have created mystique with smoke and mirrors (and pricing) that isn’t borne out by the reality of the product. She says that's led to the success of direct-to-consumer online luxury brands such as Everlane, because truly affluent consumers—not the aspirational pretenders—would rather buy a high-quality leather bag for $200 from Everlane than a $1500 Louis Vuitton tote that isn’t leather and isn’t even made nearly as well as it used to be, she said.

“Luxury is based on these illusions but Millennials are just not buying into it. They have a whole new mindset that so many luxury brands don’t want to deal with, because it pulls back the curtain on all the smoke and mirrors. Millennials have been marketed to so much throughout their lifetime, they can sniff out a marketing message and they just aren’t buying things people are trying to sell them.”

It’s not that Millennials are not into luxury, status, or material goods, says Danziger. They are, but access matters more than ownership, hence the popularity of rental sites like Rent The Runway, Uber, AirBnB, etc.

“This generation defines themselves by who they are more than what they have,” she said. Their status symbols are education and achievement, not traditional trappings or possessions, as evidenced by a focus group Danziger held of affluent Millennials with graduate level education in lucrative career paths. “They said, ‘the initials behind my name are my status.’”

Related: When Quality Alone Isn’t Enough, It’s Intangibles That Sell Luxury

“The senior partners in a law firm wear Rolexes,” said one young attorney in the group. “My status symbol is my Timex Ironman watch, because that says I’m an Ironman. I don’t need the Rolex. Rolex says I have a lot of money, but this says I’m a triathlete.”

Another issue among affluent consumers is a growing concern for security and privacy, says Danziger. “Given the concerns about income inequality and where our culture is today, people don’t want to advertise their wealth like they used to. Income inequality is a real issue and the wealthy don’t want to reveal it or flash it under people’s noses.”

While numbers have dropped slightly, luxury consumers generally feel confident about their own financial situation, but they're hesitant to flash wealth amid growing concerns over income inequality. Chart: YouGov

In his analysis of the recent Las Vegas jewelry shows, Golan says large goods—10+ carats and above—did not fare well in Las Vegas. Sales were slow and prices are sinking fast. Sales of typical American commercial market stones—caraters and below—were better, but prices are still falling.

Finished jewelry, meanwhile, was again a barbell in Las Vegas: both low-end and high-end goods fared well, with softness in the $1,000 to $5,000 range—ironically the very range that is considered a sweet spot for female self-purchase, which the diamond industry is now pushing hard.

What’s a jeweler to do? That’s a very good question, admits Danziger. And the answer isn’t simple. “All you have to do is look at Tiffany. They’re struggling mightily. They’ve got this tremendous brand name that everybody knows, but they’re still struggling with trying to find right mix of product, innovation, and marketing to succeed.”

Luckily for independent jewelers and other retailers, she feels small is a very strong place to be—and 90% of independent retailers’ customer traffic is still coming in on foot through the door.

“Small independents have real advantage over big ones. They know their customers and know their community. Maybe all the people in the community aren’t their customers yet, but to me it’s basic Retail 101. Understand what they want and deliver it to them.”

“We try to give simple answers to complex problems, but there’s no simple answer. Jewelry doesn’t mean to many younger people what it meant to previous generations. I’m amazed at young women that have covered their bodies with tattoos, but they’ve chosen to adorn themselves that way, not with jewelry like Baby Boomers did.”

While many articles have been written about how Millennials don’t want their parents’ brown furniture or china collection, they often will hang onto jewelry if for no other reason than it doesn’t take up a lot of space and it has inherent value beyond the marketing of its logo, says Danziger. But Golan argues that marketing a diamond on the basis of something that maintains its value is economic-speak, not love or experience.

Either way, restyling offers a potential growth opportunity for jewelers, especially as recycled gold and diamonds tap right into consumers' desire for sustainability, quality of life, and not quantity of things.