Articles and News

Just How Effective Is That Facebook Page For Your Sales? | November 12, 2014 (0 comments)

New York, NY—As social media matures, the winners and losers among the different platforms are increasingly obvious. And now that social media is a given part of a business’s overall marketing strategy, where do the various social platforms fall in terms of what they deliver? L2 ThinkTank, a New York-based agency that measures the digital marketing effectiveness of luxury brands, has released a new study that measures the actual effectiveness of the social platforms themselves, and how brands in various categories are using those.

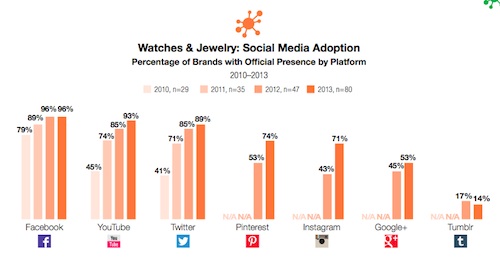

Many luxury brands have tried to be everywhere at once, says L2, participating in an average of seven social media platforms per brand. Adidas, the German-based sports brand, tops the list with presence on 13 social media platforms worldwide. In the 2013 Jewelry and Watch Digital IQ report, released last December (2014 will be released shortly, says L2), seven social media platforms ranked among jewelry and watch brands: Facebook, YouTube, Twitter, Pinterest, Instagram, Google+, and Tumblr.

Facebook remains the 800-lb. gorilla among social sites, though its year-on-year growth has slowed to zero among all brand categories. But that simply means that almost all luxury brands are already using it. Facebook adoption within L2’s Watches and Jewelry category, for example, is ubiquitous, says Danielle Bailey, the lead researcher for the social media IQ study.

As of last year, Facebook maintained a lead among jewelers' favorite social media platforms. Source: L2ThinkTank

Additionally, YouTube, Twitter, and Instagram have also been fertile ground for these brands, and they are approaching Facebook’s adoption rate, says Bailey.

“Due to the visual nature of the platform where product images shine and users can flaunt their ‘bling,’ Instagram activity has exploded in watches and jewelry. Instagram adoption for the category stands at 90% and is up 33% year on year,” she told The Centurion.

Brands in the Watches and Jewelry category have shied away from platforms like Vine and Snapchat targeting younger demographics, and from emerging platforms in some Asian markets, namely Japan and South Korea, adds Bailey. But in China, watch and jewelry brands have been aggressive about using social media, although Western platforms like Facebook and Twitter aren’t available there. But more than three-quarters of watch and jewelry brands are on Sina Weibo and more than half are on video platform Youku and WeChat. Watches & Jewelry category adoption of WeChat—China’s hottest platform—is up 44% year on year, more than any other platform, including Instagram, says Bailey.

Pinterest is losing its luster overall, but it’s still strong in the bridal market, including jewelry. Brands like Hearts On Fire that market heavily toward the bridal segment do well on Pinterest, but the site (that once had rocket-fast growth) has seen adoption drop 22% year on year, says Bailey.

“Swarovski is also very strong on Pinterest due to an early partnership to sponsor content on the platform, [but] other brands have struggled with how to use the platform, ceasing activity after an initial photo dump,” she says. “Accumulating followers and activity on their page should not be the focus for brands as 80% of Pinterest engagement occurs outside of official brand accounts,” she added.

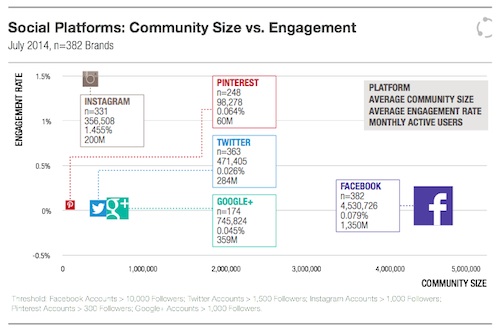

Jewelers still lead in social engagement. The relationship between community size and engagement is an inverse one, says Bailey. Smaller social communities in general experience larger engagement, and the jewelry and watch category tops all others in terms of engagement with its followers. The outsized engagement experienced by the category is also a reflection of aficionados who have been brought out of the woodwork of web forums and now have digital homes on social and a direct connection with brands. Product images—whether user-generated images, campaign shots, or stock photos from brand websites—resonate across social platforms.

Although jewelry and watches is the category with the highest engagement overall, by platform the highest engagement rate is with Instagram. Facebook is second. Source: L2Thinktank.

The biggest general change in digital marketing of jewelry brands is commercialization of digital platforms, Bailey told The Centurion. When brands initially began using email marketing and social media, their content was all about branding and lifestyle; they typically didn't provide any call to action or drive to commerce/conversion.

Now, however, brands realize that their digital channels are used for research at the top of the purchase funnel, and that affluent consumers (indeed, most consumers) begin their purchase process online, even if they ultimately end up converting in-store.

Even Rolex, which was just about last among its peers to adopt digital marketing, now is using social as a broadcast and advertising medium. The brand advertises on high quality digital properties, and sponsors digital content such as The Economist’s “Timekeeper” article saving feature.

This trend may well continue as social platforms push to drive advertising revenue. According to L2’s report, Facebook’s algorithm change has driven its organic reach from 12% in April 2012 to the low single digits, and companies that want to ensure visibility and engagement must advertise. Other platforms also have intensified their advertising efforts, but to date none can rival Facebook’s targeting abilities on a grand scale.