Articles and News

Luxury After COVID: The Ultra-Rich Will Snap Back But The Merely Affluent, Not So Fast | June 17, 2020 (0 comments)

Stevens, PA—If you’re counting on a huge surge of pent-up demand as soon as the coronavirus pandemic is under control, you might want to tamper your expectations. Image: Holger Detje, Pixabay

That’s the word from renowned luxury market researcher Pam Danziger of Unity Marketing. In a new whitepaper titled The HENRYs After COVID-19: What Comes Next for the Luxury Market, she explores some likely scenarios for the luxury market in a post-COVID world. While not all is doom and gloom, her research suggests the aftermath of this crisis is going to have a far greater impact on luxury marketers and retailers than the Great Recession.

Based on forecasts from the “big three” consulting firms (Bain, Boston Consulting, and McKinsey), the luxury market is likely to shrink anywhere from 20% to 39% in 2020. But the psychological, emotional element of the pandemic—a variable missing from the Great Recession and other downturns—makes the pandemic a true black swan and greatly complicates economic forecasting. Bain predicts it will be late 2022 or early 2023 before the luxury market returns to 2019 levels, says Danziger, and the ultra-rich will come back first, just as they did after the Great Recession. Financially, they still have nothing to worry about through this crisis, but the pandemic is taking an emotional toll on them too. Initially, says Danziger, they might not come back with the same enthusiasm as pre-COVID as this crisis has spurred everyone to reassess their priorities, but they will be back.

But Danziger warns it’s the next tier of affluent consumers, the ones she calls HENRYs (an acronym for High Earner Not Rich Yet) who are feeling uncertain--if they're not already negatively impacted by the coronavirus pandemic. These are the mass-affluent consumers with household income between $100,000 and $250,000: the white-collar professionals in healthcare, law, marketing, science, finance, and more, who the AP reports are now starting to see layoffs and pay cuts as the pandemic continues to take its economic toll.

Related: How To Tap Into HENRY Spending Power

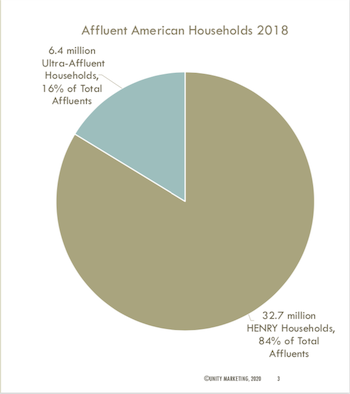

While HENRY consumers’ individual luxury spending might not be on a par with the ultra-rich, by sheer volume they account for 85% of affluent households and a lot more total luxury dollars spent. Ultra-affluents account for about 10% of consumer spending; HENRYs, about 40%. (The remaining half is non-affluent households below $100,000.)

That’s a lot of luxury spending that is likely to drop off, says Danziger. “In the new normal, post-coronavirus world, the luxury market is going to be profoundly changed by the HENRYs’ mindset, priorities, and values.”

Even though the ultra-rich (blue slice) can outspend the merely affluent (brown slice) by a hefty margin, the sheer volume of "HENRY" (High Earner Not Rich Yet) affluent households will have a formidable negative impact on luxury sales if they rein in spending.

During the lockdowns, consumers had a lot of time to not just worry but also reassess their priorities. They’ve had ample time to reflect on what’s important to them, and Danziger predicts their spending habits are likely to take a radical shift from indulging in luxury goods as much as their income allows, to saving and only occasionally indulging in more modest, discreet luxuries where high quality and long-lasting utility take precedence.

These findings were correlated by a new De Beers study of American consumers released this week. In it, 45% of consumers surveyed said they plan to buy fewer but better things.

That signals good news for jewelry: high quality and long-lasting utility are hallmarks of fine jewelry and watches. So too is the emotional aspect of jewelry that’s not present in some other luxury categories. And, finally, De Beers’ research shows independent jewelers rank in customers’ minds as the safest physical option to shop for jewelry during the pandemic.

Decluttering has been a key part of how affluent consumers are spending their time in quarantine. This isn’t a new trend, as the Marie Kondo empire demonstrates, but consumers have turned their focus toward it in ways they hadn’t before.

“I don’t know any luxury consumer who hasn’t got more stuff than they know what to do with,” says Danziger. Furthermore, being forced to stop in their tracks has made people realize that acquiring mountains of stuff doesn’t make them happier. Danziger predicts that when consumers do return to stores, they will apply the same rigorous standards of decluttering to any potential new purchases. (Editor’s note: The Associated Press on Tuesday reported a new survey showing Americans are the unhappiest they’ve been in 50 years.)

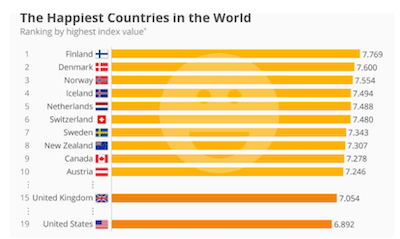

Even prior to the AP report about American unhappiness, Danziger's chart showed Americans trailing many other first-world nations in general happiness.

Another reason why affluent—and especially ultra-rich—consumers may rein in any kind of conspicuous consumption is because the coronavirus pandemic has sharply highlighted income inequality. Not only has the greatest pain and misery of the pandemic fallen on the lower classes, but reports of rich people hoarding food and flying their private jets to escape is not lost on those who are suffering. (Editor’s note: Danziger’s report was produced before the protests and riots sparked by George Floyd’s death, but the fact that so much of the violence took place in luxury shopping areas suggests a deeper anger that includes income inequality along with racial inequality.)

Related: Where Is The Luxury Jewelry Market Going, And Where Do You Fit In?

As a corollary, wellbeing is emerging as a new luxury, which will spark some new categories of competition around wellness, both physical and emotional and redirect dollars toward both personal care and personalized medicine, as well as—later—wellness tourism and spa experiences.

Although retail sales made a stunning rebound of 17.7% in May--the biggest one-month jump ever--analysts remain cautious and warn that the economy has a long way to go to recovery. As encouraging as the numbers are, they should be taken with a grain of salt. To wit, clothing and accessories sales leapt 188% between April and May 2020--but they're still down 63% from May 2019 and total sales (counting all categories, including the ones that have been outperforming, such as groceries) are down 6% year-on-year. Some of those numbers also may have been bolstered by government assistance, whether in the form of unemployment compensation--which runs out next month--or stimulus checks.

Finally, just as the Great Recession left its long-term mark on Millennials' and Gen-Z's consumer behavior, financial wellbeing will be as important to HENRY consumers as physical and emotional wellbeing. Danizger points out that people don’t reach a state of financial wellbeing and security by spending all their money. While luxury says to the world that you’re doing well and can afford it (or charge it), the kind of spending that comes after hard times tends to reflect identity and security. Short-term backlash spending may be evident for a time, but it’s unlikely to last, whereas anxiety about financial security is likely to last for some time.

To purchase Danziger’s full report, click here.