Articles and News

McKinsey & Co. Report Says Future Is Not “Back To” Normal, It’s The “Next Normal” | September 02, 2020 (0 comments)

New York, NY—As businesses begin to reopen after lockdown, it might feel like we’re on the verge of returning to normal—but a research report from consultancy McKinsey & Co. says that’s unlikely.

Reopening will not return things to how they were in 2019 and the early days of 2020. Instead, we’re writing a new future as we emerge from lockdown and isolation, says McKinsey. It has identified six potentially important changes in consumer behavior that will constitute the “next normal.”

Some are meaningful accelerations of existing trends and some are just beginning to emerge, say McKinsey’s consultants. While they caution this is not an exhaustive list and they don’t guarantee certainty or duration of any of the changes, these trends are worth noting, says the report. Here are some excerpts from McKinsey’s research:

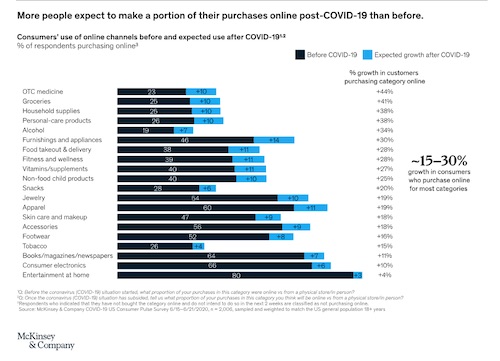

1. Digital rockets. In the space of eight weeks, consumers leapt ahead five years in adoption of digital shopping, says McKinsey. Consumers around the world are seeking both digital and reduced-contact ways of accessing both products and services. In the United States, this trend is especially pronounced in Gen-Z, Millennials, and higher income consumers in general. This is a shift that McKinsey’s analysts expect to stick—and so far, evidence from the jewelry industry proves them right.

2. Home as hub. Now that it’s a place where people live, work, learn, shop, and play, spending on groceries, household supplies, and home entertainment has remained resilient during the crisis. But in a late June McKinsey survey of consumer spending intent, furnishings and appliances declined 32 points, potentially in reaction to the economy. Jewelry and accessories declined 35 and 33 points, respectively—at odds with findings from The Edge Retail Academy and De Beers. Even Macy’s reports sales of jewelry and high-end accessories are up, and De Beers’ research says the emotional factor of jewelry resonates with consumers more than ever.

3. Local is key. Not surprisingly, the near-total shutdown of travel has made local neighborhoods more important, but this merely accelerated an existing trend toward supporting familiar, local businesses. The challenge, says McKinsey, will be standing out from other brands while addressing people’s shifting concerns and behaviors.

Related: Diamonds Can Capture Unspent Travel Dollars

4. Personal health and economic wellbeing are, not surprisingly, top-of-mind concerns. Foot traffic to stores (and everything else) will return only when people trust that spaces are safe and virus-free. McKinsey found the top reasons consumers give for deciding whether to go to a store include not only increased cleaning and disinfecting but also a mandate that all employees and customers wear masks. Consumers of all ages also are more widely adopting contactless shopping activities, whether it’s self-checkout or scan-and-go or curbside pickup. Jewelers are adapting in creative ways.

This chart from McKinsey & Company shows a 19% increase in consumers buying jewelry online.

5. A new thrift. Brand loyalty is being challenged. As in other downturns, consumers are making thriftier choices in filling their baskets, and value is replacing luxury as a desirable attribute.

6. More data privacy concerns. Consumers were already concerned about privacy and data sharing, but the increase in activities such as temperature-taking or wearable devices that transmit health information is also raising concerns about privacy.

7. A higher standard of purpose. Consumers demanding social responsibility from brands and retailers was already a growing trend, but the pandemic (along with the recent surge in activism) is giving them a greater sense of power and a louder voice. Almost two thirds (61%) of respondents to McKinsey’s survey said that how a brand responds during the crisis will have a large impact on whether they continue buying from it when the crisis is over.

8. Agility is key to survival. “While no one knows what the exact contours of the next normal will look like, we do know that things will not go back to the way they were,” say McKinsey’s experts.

Liz Hilton Segal, managing partner for McKinsey in North America, says the most common pitfall she sees is companies being too grounded even in the recent past. Don’t assume that things that held true in the recent past will be true two or three years from now, she says, but rather “try to look around the corner and anticipate how trends are going to affect your business and then to prepare for those trends and build capabilities that will lean into them.”

Sajal Kohli, McKinsey’s global leader of its Consumer Packaged Goods and Retail Practices, says it’s amazing how agile organizations have been in the past three months, and this should be the new way of working as we go forward.