Articles and News

Millennial Self-Purchase Females Ripe For Entry-Luxury Brand Offerings | August 07, 2018 (0 comments)

Austin, TX—Millennial-age women are far more likely to buy fine jewelry for themselves than they are to buy it together with their partner or to wait for it to be gifted, finds a new study from MVI Marketing LLC. These consumers are at the beginning of a 30+ year spending cycle with brand attachments still in the formative stage, says MVI’s research. Moreover, 41% of them can be counted on to post something on social media about brands they like, becoming de facto brand ambassadors, while another 41% will occasionally give a shout-out to brands they like. MVI's respondents said Facebook is the most likely social platform they’ll use (62.5%), followed by Instagram (27.5%) and, in distant third, Pinterest (5.9%).

Whatever the platform, visuals are important. An article in BrandKnewMag and Luxury Daily says visual channels allow them to discover everything from boutiques to cool new products to must-have tips and styling options to help them evaluate potential purchases. The content, rather than being used to position themselves as experts, helps shape their consumer purchasing journey.

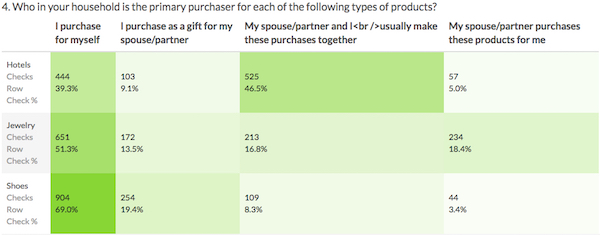

Almost two-thirds (64.8%) of respondents to the MVI study said they’re the primary buyers of jewelry in their household. 51.3% said they’re the primary purchaser of jewelry for themselves—still significantly higher than all the other categories combined. 18.4% said their spouse or partner buys jewelry for them, 16.8% said they usually make jewelry purchases together with their spouse or partner, and 13.5% say they will buy jewelry for their spouse or partner.

The study was conducted in mid-July, among 1,001 U.S. Millennial age women (ages 25-40) with household income of $75,000 or higher. It focused on three core luxury product categories: jewelry, shoes and hotels.

The results reinforce reasons for optimism for luxury brands seeking an entry level point with millennial consumers, says Liz Chatelain, MVI president. In general, respondents to the study identified the top three self-purchase drivers as:

- To can get exactly what they want

- To celebrate a milestone

- Just because

Nearly 91% indicated they research a brand before buying.

In the shoe category respondents to this study rated Coach, Kate Spade, Louis Vuitton, Jimmy Choo, Tory Burch, and Gucci as the top shoe brands they own or are most likely to purchase; nearly 60% will spend up to $150 on their next shoe purchase.

In the hotel category, over 40% will travel at least once a year with girlfriends, and the hotel brands they will most likely book for themselves are Hilton, Marriott and Hyatt.

For jewelry, respondents rated Tiffany, Pandora, Swarovski, Alex & Ani, Gucci, Tory Burch, and David Yurman as the top jewelry brands they own or are most likely purchase.

Many of the top brands respondents cited are better examples of entry or affordable luxury than high luxury, further emphasizing the need for jewelers to offer brands that fit into that price sphere if they want to attract this customer. Still, MVI's survey echoes findings of other surveys, showing some heritage high luxury brands have remained relevant and resonate with Millennial women. In a separate survey, Luxury Daily and BrandKnewMag report that one-third of Millennial women favor established, yet stylish brands.

Related: Wealthy Millennials Favor Heritage Luxury Brands In Jewelry And Watches

Not surprisingly, earrings are the jewelry category they’re most likely to buy, followed in order by necklaces, rings, bracelets and watches. What is surprising is that despite a strong fashion trend for yellow gold that has been going on for several years, white metal is greatly preferred by respondents. 35.2% listed white gold as their favorite metal of choice, followed by silver, platinum, rose gold, then yellow gold.

Diamonds—in whatever form—are still a girl’s best friend. MVI, which also has been tracking consumer interest in lab-grown diamonds, first asked respondents to rank their favorite kinds of jewelry. Diamonds figured in most combinations.

In this study, over 13% of respondents said they are very likely to purchase lab grown diamonds, over 43% said maybe they would purchase lab grown diamonds but don't know much about them and 21% said probably they would purchase lab grown diamonds as they are hearing more about them.

Related: Mined or Manmade? What Do Millennials Really Want In A Diamond?

While conventional wisdom paints Millennials as a generation that’s still living at home and bowed under the weight of student loan debt, Chatelain thinks the results of the most recent study give great cause for optimism.

“You can see all the signs of a demographic segment that will be spending for themselves, and for gifts, in increasing numbers and escalating price points,” she said.

Content engagement, style, and adornment are what will propel brand loyalty, says Chatelain. “Luxury brands like Tiffany, Marriott, and Jimmy Choo are already seeing strong penetration based on their recent video content marketing efforts, and others seeking an answer to the Millennial consuming puzzle should become more aggressive with their content marketing to young self-purchasing females.”

The full report is available at MVIMarketing.com

Top image: BrandKnewMag