Articles and News

Want to Attract More Customers? Try Offering Secondhand Jewelry | September 08, 2020 (0 comments)

New York, NY—Retail might be stumbling in a number of sectors, but resale is rocketing. ThredUp, a leading fashion resale site, published its 2020 Resale Report in March, just as the pandemic lockdowns were sweeping the nation. (Image: ThredUp's vast warehouse has moving racks of secondhand clothing both coming in and going out.)

It may seem counterintuitive that a quarantine would drive sales of secondhand goods up, but that is in fact exactly what’s happening. Meanwhile, the rocketing price of gold at a time when many Americans are struggling with unemployment might drive consumers to sell off their jewelry—and give jewelers a chance to offer more affordable secondhand goods to consumers who might be more price-sensitive than they were a year ago.

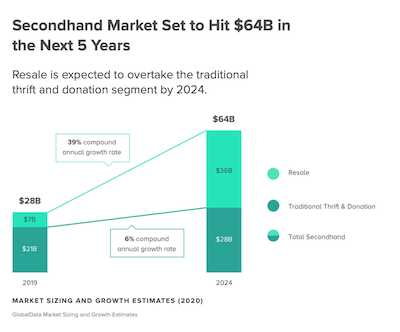

The secondhand market itself is comprised of two main segments: resale, and traditional thrift and donation. Together, they accounted for $28 billion in sales in 2019, and estimates are that it will more than double to $64 billion by 2024, with resale leading the way.

In 2019, resale grew 49%. That’s 25 times faster than the 2% gain in the broader retail sector, says ThredUp’s study. And for apparel specifically—which is ThredUp’s focus—total retail clothing sales declined 4% year-on-year in 2019.

GlobalData, the retail analytics firm that partnered with ThredUp for the study, estimates a 39% compound annual growth rate, bringing the resale segment from $7 billion to $36 billion, whereas the more mature thrift/donation segment will experience a 6% CAGR, bringing it from $21 billion to $28 billion in that time.

Related: Pre-Owned Jewelry Leads Secondhand Luxury Goods Market

Why is resale booming during quarantine?

Online thrifting is a bright spot in what has thus far been a broader COVID retail slump. Even though ThredUp’s weekly gross transaction values were down from mid-March to May vs. January through mid-March, they’re still up by 20% (vs 43% prior to lockdown). And while both offline secondhand and total retail are currently down 25% and 20%, respectively, online secondhand has risen more than 25% so far this year.

ThredUp's Resale Report shows how fast the resale segment is growing. Last year, it was a small fraction of the total secondhand market compared to traditional thrift and donation centers (bright green bar at left); by 2024 it is expected to comprise the majority of the secondhand market. Chart: ThredUp and GlobalData.

Part of the reason is what the study calls a "quarantine clean-out frenzy: 50% of people are cleaning out their closets more than they did prior to quarantine, leading to a 6.5-times increase in requests for Thred-Up’s Donation Clean-Out Kits. In May, shoppers spent a total 2.2 million hours browsing Thred-Up, a 31% increase."

ThredUp doesn't offer jewelry, even under its "accessories" tab, but other online resale sites do, most notably luxury online consignment site TheRealReal, which specializes in high-end designer brands and offers quite a lot of fine jewelry and luxury watches. Vestiaire, another luxury site, also sells jewelry, as does Poshmark, though its offerings also include costume jewelry. Then, too, many local brick-and-mortar consignment shops across the country also will sell fine jewelry, particularly if it's a name brand and therefore easy to establish a valuation.

Just as we saw consumers shifting to new habits in the wake of the Great Recession, McKinsey & Company predicts the next normal has started to emerge, and many of the behavior changes that consumers have begun to adopt will remain. Some findings:

- 88% of consumers who adopted a thrifty new hobby such as gardening or mending clothes during quarantine plan to continue with it.

- 79% of consumers plan to cut their apparel budget in the next 12 months.

- Four out of five people said they either have or are open to shopping secondhand when money gets tight, and two out of three people who never sold their clothes before say they’re open to it. Again, the number-one reason is to make money.

- Not surprisingly, the receptiveness to second-hand goods is highest with Gen-Z and Millennials, with 40% and 30%, respectively, of consumers reporting they’ve bought secondhand apparel, footwear, or accessories in 2019. Penetration is least among Boomers and Gen-X-ers, of which only 20% have.

Finally, vintage fashion scores points among younger generations as both sustainable and a way to express a unique style.