Online Gray Market Growing For Luxury Jewelry And Watches, Discounts Up To 65%

January 30, 2018 (0 comments)

New York, NY—Last fall, a study by digital research firm

L2 found that by not having e-commerce capabilities, jewelers are not only hurting their own brick-and-mortar sales, but also helping gray marketers grow.

Read all about the initial study here.

In a follow-up study released last week, L2 found the performance divergence between online and offline channels is growing in the jewelry and watch space. Digital jewelry and watch sales were robust during the holiday 2016 period: not only were online sales were up double digits year-on-year, but Amazon—which overall declared 2016 its

best holiday ever—sold 2.5 million watches and 10,451 carats of diamonds during the holiday period. (A

report from Pymnts.com says 83% of Americans used Amazon last year, and an

article on Time.com/Money says more than 70% of affluent Americans and more than 50% of all Americans are Amazon Prime members.)

In

The Centurion's final 2016 holiday survey, about one-third of respondents reported double-digit sales increases for the season, and more than one-third of respondents to a

Centurion survey in the middle of the holiday shopping season

felt their digital efforts were paying off. Only about 17% of respondents reported increased online sales, but almost half of respondents (48%) said they are not e-commerce enabled.

But consumers love bargains, especially on luxury goods like jewelry and watches. There are now more than 65 gray market sites selling luxury watches and jewelry at discounts ranging from approximately 33% to as much as 65% off. The gray market exploded as Swiss watch sales declined; as

Fortune magazine explains, luxury watchmakers ramped up production to meet the demands of a then-booming Asia, Middle East, and Russia, but a subsequent slowdown in those regions led to a glut of inventory that has to be unloaded somewhere.

When a brand’s own site or its authorized retailers aren’t offering either price transparency or e-commerce, consumers head to gray market sites, says L2’s research. In a January 2017 analysis, L2 looked at 475 SKUs across 36 brands, and found that on the top four jewelry/watch gray market sites—Ashford, Jomashop, Chrono24, and Authentic Watches—discounts were 49%, 33%, 28% and 25%, respectively, for an identical item also shown on a brand’s website.

And, as L2’s

fall 2016 report emphasized, the gray marketers’ investments in search engine optimization (SEO) often is much greater than legitimate marketers’, pushing their sites higher in rankings.

As is standard with its

category reports on digital marketing strategies, L2 examined 70 luxury jewelry and watch brands, ranking their efforts from Genius to Feeble. Scores were calculated in four categories: website and e-commerce (40% of total score), including search and navigation, e-commerce and fulfillment, product pages, guided selling, customer service and store locator, and account loyalty; digital marketing (35%), including search, web advertising, email marketing, and earned media mentions on related sites such as Hodinkee; social media (10%), including but not limited to Facebook, YouTube, and Instagram; and finally, mobile (15%), including mobile site/smartphone experience, mobile search, and advertising and apps, if applicable.

The top 10 brands in order of ranking were Tiffany, Cartier, Swarovski, Pandora, David Yurman, Tag Heuer, Montblanc, Alex & Ani, Longines, and Van Cleef & Arpels. Other brands and rankings of interest included Shinola (ranked number 12), Ippolita (25), Hearts On Fire and Rolex (tie, 26), Links of London (32), Forevermark (37), and Roberto Coin (44).

With 75% of all luxury sales influenced by online research first, investment in site features that facilitate product discovery is growing, says L2. 85% of brands in L2’s Index now support site search, up from 76% a year ago, and 82% employ cross-selling tactics on their product pages, compared to 47% percent in 2015. Investments in “quick view” functionality and product customization also increased, says L2.

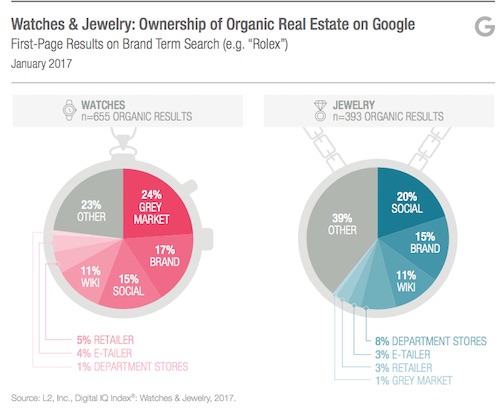

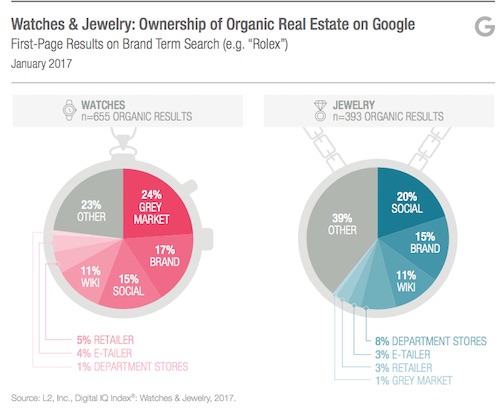

71% of luxury consumers use a search engine, illustrating the importance of search as a marketing strategy. L2 says its Index brands did increase investment in search in 2016; and despite the proliferation of gray market sites, brands overall still performed relatively well in search on their own branded terms. Brands secured 51% of the top three organic results on Google; all grey market retailers combined captured 15% of those results. But L2 observed the gray market impact is more pronounced in watches, resulting in nearly 25% of first-page results on brand terms, and much lower for jewelry, with the grey market only capturing 1% share of first-page search results. As each search query becomes more specific (i.e., Rolex Submariner vs. just Rolex), all three—gray marketers, authorized retailers, and brand pages—increase their share of results. Jewelry brands perform much better than watch brands on specific queries; L2 found their share doubles. Retailers, however, still capture a minute percentage of search results.

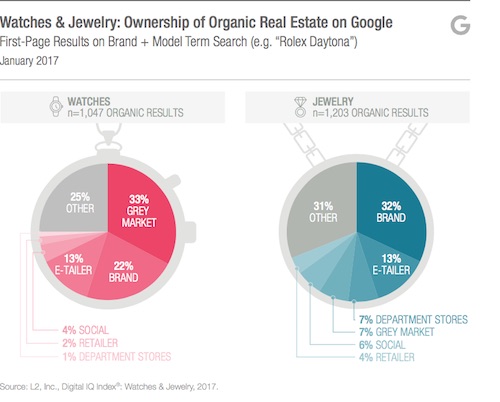

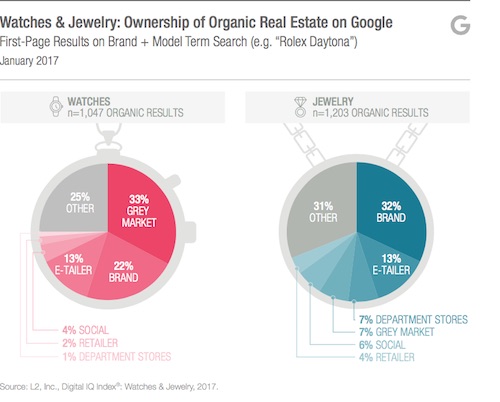

According to L2's research, retailers garner about 4% of search results when a luxury watch brand (such as "Rolex") is entered into a search engine, and about 3% when a luxury jewelry brand is entered, above. But when a specific model (such as "Rolex Daytona") is entered, retailer's share of search results declines slightly for watches (below left) but increases slightly for jewelry (below right). Charts source: L2.

According to L2's research, retailers garner about 4% of search results when a luxury watch brand (such as "Rolex") is entered into a search engine, and about 3% when a luxury jewelry brand is entered, above. But when a specific model (such as "Rolex Daytona") is entered, retailer's share of search results declines slightly for watches (below left) but increases slightly for jewelry (below right). Charts source: L2.

Video is a social-media essential.

Video is a social-media essential. For luxury jewelry and watch brands in L2’s Index, Instagram is outperforming Facebook almost fivefold in terms of engagement numbers. But when YouTube enters the mix, it’s clear the video platform is the 800-pound gorilla of social media effectiveness: 78% of brand interactions occur there, compared to 18% on Instagram and 4% on Facebook. YouTube garners more engagements in the jewelry and watch space than any other similar category L2 studied: even beauty is less video-focused than jewelry and watches, with a 63% engagement rate for YouTube vs. 78% in jewelry and watches. Department stores rank even lower (55% engagement) and fashion limps in at an abysmal 21% engagement rate.

While it may be the political channel of choice, L2’s research found Twitter is essentially worthless for engaging consumers with luxury brands. It barely captures 1% of total engagements—and then only when YouTube is taken out of the calculation. With YouTube included, it doesn’t register at all for jewelry and watches, and barely ekes out 1% engagement with fashion brands or department stores.

To learn more about L2’s research or the full study results,

click here.

New York, NY—Last fall, a study by digital research firm L2 found that by not having e-commerce capabilities, jewelers are not only hurting their own brick-and-mortar sales, but also helping gray marketers grow. Read all about the initial study here.

In a follow-up study released last week, L2 found the performance divergence between online and offline channels is growing in the jewelry and watch space. Digital jewelry and watch sales were robust during the holiday 2016 period: not only were online sales were up double digits year-on-year, but Amazon—which overall declared 2016 its best holiday ever—sold 2.5 million watches and 10,451 carats of diamonds during the holiday period. (A report from Pymnts.com says 83% of Americans used Amazon last year, and an article on Time.com/Money says more than 70% of affluent Americans and more than 50% of all Americans are Amazon Prime members.)

In The Centurion's final 2016 holiday survey, about one-third of respondents reported double-digit sales increases for the season, and more than one-third of respondents to a Centurion survey in the middle of the holiday shopping season felt their digital efforts were paying off. Only about 17% of respondents reported increased online sales, but almost half of respondents (48%) said they are not e-commerce enabled.

But consumers love bargains, especially on luxury goods like jewelry and watches. There are now more than 65 gray market sites selling luxury watches and jewelry at discounts ranging from approximately 33% to as much as 65% off. The gray market exploded as Swiss watch sales declined; as Fortune magazine explains, luxury watchmakers ramped up production to meet the demands of a then-booming Asia, Middle East, and Russia, but a subsequent slowdown in those regions led to a glut of inventory that has to be unloaded somewhere.

When a brand’s own site or its authorized retailers aren’t offering either price transparency or e-commerce, consumers head to gray market sites, says L2’s research. In a January 2017 analysis, L2 looked at 475 SKUs across 36 brands, and found that on the top four jewelry/watch gray market sites—Ashford, Jomashop, Chrono24, and Authentic Watches—discounts were 49%, 33%, 28% and 25%, respectively, for an identical item also shown on a brand’s website.

And, as L2’s fall 2016 report emphasized, the gray marketers’ investments in search engine optimization (SEO) often is much greater than legitimate marketers’, pushing their sites higher in rankings.

As is standard with its category reports on digital marketing strategies, L2 examined 70 luxury jewelry and watch brands, ranking their efforts from Genius to Feeble. Scores were calculated in four categories: website and e-commerce (40% of total score), including search and navigation, e-commerce and fulfillment, product pages, guided selling, customer service and store locator, and account loyalty; digital marketing (35%), including search, web advertising, email marketing, and earned media mentions on related sites such as Hodinkee; social media (10%), including but not limited to Facebook, YouTube, and Instagram; and finally, mobile (15%), including mobile site/smartphone experience, mobile search, and advertising and apps, if applicable.

The top 10 brands in order of ranking were Tiffany, Cartier, Swarovski, Pandora, David Yurman, Tag Heuer, Montblanc, Alex & Ani, Longines, and Van Cleef & Arpels. Other brands and rankings of interest included Shinola (ranked number 12), Ippolita (25), Hearts On Fire and Rolex (tie, 26), Links of London (32), Forevermark (37), and Roberto Coin (44).

With 75% of all luxury sales influenced by online research first, investment in site features that facilitate product discovery is growing, says L2. 85% of brands in L2’s Index now support site search, up from 76% a year ago, and 82% employ cross-selling tactics on their product pages, compared to 47% percent in 2015. Investments in “quick view” functionality and product customization also increased, says L2.

71% of luxury consumers use a search engine, illustrating the importance of search as a marketing strategy. L2 says its Index brands did increase investment in search in 2016; and despite the proliferation of gray market sites, brands overall still performed relatively well in search on their own branded terms. Brands secured 51% of the top three organic results on Google; all grey market retailers combined captured 15% of those results. But L2 observed the gray market impact is more pronounced in watches, resulting in nearly 25% of first-page results on brand terms, and much lower for jewelry, with the grey market only capturing 1% share of first-page search results. As each search query becomes more specific (i.e., Rolex Submariner vs. just Rolex), all three—gray marketers, authorized retailers, and brand pages—increase their share of results. Jewelry brands perform much better than watch brands on specific queries; L2 found their share doubles. Retailers, however, still capture a minute percentage of search results.

New York, NY—Last fall, a study by digital research firm L2 found that by not having e-commerce capabilities, jewelers are not only hurting their own brick-and-mortar sales, but also helping gray marketers grow. Read all about the initial study here.

In a follow-up study released last week, L2 found the performance divergence between online and offline channels is growing in the jewelry and watch space. Digital jewelry and watch sales were robust during the holiday 2016 period: not only were online sales were up double digits year-on-year, but Amazon—which overall declared 2016 its best holiday ever—sold 2.5 million watches and 10,451 carats of diamonds during the holiday period. (A report from Pymnts.com says 83% of Americans used Amazon last year, and an article on Time.com/Money says more than 70% of affluent Americans and more than 50% of all Americans are Amazon Prime members.)

In The Centurion's final 2016 holiday survey, about one-third of respondents reported double-digit sales increases for the season, and more than one-third of respondents to a Centurion survey in the middle of the holiday shopping season felt their digital efforts were paying off. Only about 17% of respondents reported increased online sales, but almost half of respondents (48%) said they are not e-commerce enabled.

But consumers love bargains, especially on luxury goods like jewelry and watches. There are now more than 65 gray market sites selling luxury watches and jewelry at discounts ranging from approximately 33% to as much as 65% off. The gray market exploded as Swiss watch sales declined; as Fortune magazine explains, luxury watchmakers ramped up production to meet the demands of a then-booming Asia, Middle East, and Russia, but a subsequent slowdown in those regions led to a glut of inventory that has to be unloaded somewhere.

When a brand’s own site or its authorized retailers aren’t offering either price transparency or e-commerce, consumers head to gray market sites, says L2’s research. In a January 2017 analysis, L2 looked at 475 SKUs across 36 brands, and found that on the top four jewelry/watch gray market sites—Ashford, Jomashop, Chrono24, and Authentic Watches—discounts were 49%, 33%, 28% and 25%, respectively, for an identical item also shown on a brand’s website.

And, as L2’s fall 2016 report emphasized, the gray marketers’ investments in search engine optimization (SEO) often is much greater than legitimate marketers’, pushing their sites higher in rankings.

As is standard with its category reports on digital marketing strategies, L2 examined 70 luxury jewelry and watch brands, ranking their efforts from Genius to Feeble. Scores were calculated in four categories: website and e-commerce (40% of total score), including search and navigation, e-commerce and fulfillment, product pages, guided selling, customer service and store locator, and account loyalty; digital marketing (35%), including search, web advertising, email marketing, and earned media mentions on related sites such as Hodinkee; social media (10%), including but not limited to Facebook, YouTube, and Instagram; and finally, mobile (15%), including mobile site/smartphone experience, mobile search, and advertising and apps, if applicable.

The top 10 brands in order of ranking were Tiffany, Cartier, Swarovski, Pandora, David Yurman, Tag Heuer, Montblanc, Alex & Ani, Longines, and Van Cleef & Arpels. Other brands and rankings of interest included Shinola (ranked number 12), Ippolita (25), Hearts On Fire and Rolex (tie, 26), Links of London (32), Forevermark (37), and Roberto Coin (44).

With 75% of all luxury sales influenced by online research first, investment in site features that facilitate product discovery is growing, says L2. 85% of brands in L2’s Index now support site search, up from 76% a year ago, and 82% employ cross-selling tactics on their product pages, compared to 47% percent in 2015. Investments in “quick view” functionality and product customization also increased, says L2.

71% of luxury consumers use a search engine, illustrating the importance of search as a marketing strategy. L2 says its Index brands did increase investment in search in 2016; and despite the proliferation of gray market sites, brands overall still performed relatively well in search on their own branded terms. Brands secured 51% of the top three organic results on Google; all grey market retailers combined captured 15% of those results. But L2 observed the gray market impact is more pronounced in watches, resulting in nearly 25% of first-page results on brand terms, and much lower for jewelry, with the grey market only capturing 1% share of first-page search results. As each search query becomes more specific (i.e., Rolex Submariner vs. just Rolex), all three—gray marketers, authorized retailers, and brand pages—increase their share of results. Jewelry brands perform much better than watch brands on specific queries; L2 found their share doubles. Retailers, however, still capture a minute percentage of search results.

According to L2's research, retailers garner about 4% of search results when a luxury watch brand (such as "Rolex") is entered into a search engine, and about 3% when a luxury jewelry brand is entered, above. But when a specific model (such as "Rolex Daytona") is entered, retailer's share of search results declines slightly for watches (below left) but increases slightly for jewelry (below right). Charts source: L2.

According to L2's research, retailers garner about 4% of search results when a luxury watch brand (such as "Rolex") is entered into a search engine, and about 3% when a luxury jewelry brand is entered, above. But when a specific model (such as "Rolex Daytona") is entered, retailer's share of search results declines slightly for watches (below left) but increases slightly for jewelry (below right). Charts source: L2.

Video is a social-media essential. For luxury jewelry and watch brands in L2’s Index, Instagram is outperforming Facebook almost fivefold in terms of engagement numbers. But when YouTube enters the mix, it’s clear the video platform is the 800-pound gorilla of social media effectiveness: 78% of brand interactions occur there, compared to 18% on Instagram and 4% on Facebook. YouTube garners more engagements in the jewelry and watch space than any other similar category L2 studied: even beauty is less video-focused than jewelry and watches, with a 63% engagement rate for YouTube vs. 78% in jewelry and watches. Department stores rank even lower (55% engagement) and fashion limps in at an abysmal 21% engagement rate.

While it may be the political channel of choice, L2’s research found Twitter is essentially worthless for engaging consumers with luxury brands. It barely captures 1% of total engagements—and then only when YouTube is taken out of the calculation. With YouTube included, it doesn’t register at all for jewelry and watches, and barely ekes out 1% engagement with fashion brands or department stores.

To learn more about L2’s research or the full study results, click here.

Video is a social-media essential. For luxury jewelry and watch brands in L2’s Index, Instagram is outperforming Facebook almost fivefold in terms of engagement numbers. But when YouTube enters the mix, it’s clear the video platform is the 800-pound gorilla of social media effectiveness: 78% of brand interactions occur there, compared to 18% on Instagram and 4% on Facebook. YouTube garners more engagements in the jewelry and watch space than any other similar category L2 studied: even beauty is less video-focused than jewelry and watches, with a 63% engagement rate for YouTube vs. 78% in jewelry and watches. Department stores rank even lower (55% engagement) and fashion limps in at an abysmal 21% engagement rate.

While it may be the political channel of choice, L2’s research found Twitter is essentially worthless for engaging consumers with luxury brands. It barely captures 1% of total engagements—and then only when YouTube is taken out of the calculation. With YouTube included, it doesn’t register at all for jewelry and watches, and barely ekes out 1% engagement with fashion brands or department stores.

To learn more about L2’s research or the full study results, click here.