Sales Strategy

With Consumer Research Showing Lab-Grown Diamonds Reaching Critical Mass, Here’s How Jewelers Can Profit October 28, 2020 (1 comment)

Austin, TX—Lab-grown diamonds have hit the mainstream. A new survey conducted by MVI Marketing LLC (THEMVEye.com), found eight out of 10 jewelry consumers overall have heard of lab-grown diamonds, and retailers are reporting higher margins on the category than for comparable mined diamonds. Among high-income consumers, 74% said they've heard of lab-grown diamonds, and 8% said they have purchased or own a piece of jewelry with one or more lab-grown diamonds.

The 2020 Lab-Grown Diamond Consumer and Trade Market Research Report is the result of comprehensive, quantitative online studies and video interviews with consumers, along with one-on-one evaluations of jewelry retailers. Marty Hurwitz, CEO of MVI Marketing, has been tracking the development of lab-grown diamonds throughout the supply chain since 2004. The 2020 study was co-sponsored by the International Grown Diamond Association (IGDA) and INSTOREmagazine. It builds on data gathered in a major consumer study conducted two years ago in September 2018, as well as past research from THE MVEye, to track the historical progression of the lab-grown diamond category.

While adoption of the category is stronger in jewelry chains—especially Helzberg and Signet—Hurwitz believes independent jewelers are an important retail channel for this category, especially now that chains have embraced it.

“Younger consumers are asking for it,” he said. “The last thing you want to have happen is for someone to ask for a product you don’t have.”

Key findings revealed in the report include:

- 80% of jewelry consumers in 2020 have heard about lab-grown diamonds, up from 58% in 2018.

- 69% of jewelry consumers in 2020 knew of brands using lab-grown diamonds, up from 49% in 2018.

- 62% of lab-grown diamond retailers report that 5-50% of diamond customers ask about lab-grown diamonds.

- Jewelers who successfully sell lab-grown diamonds report a closing ratio of 60% to 80% once customers learn about the product.

- A majority of LGD retailers surveyed (61%) expressed extreme satisfaction with the decision to stock and promote this product category.

- Nearly all (95%) of LGD retailers in the survey report better margins with lab-grown diamonds with 78% reporting LGD margins of 16% to over 40% better than mined diamonds.

- Jewelry consumers are asking for lab-grown diamonds, and they also expect the product to be among the fine jewelry offerings where they shop.

- 8% of the 1,027 jewelry consumers surveyed said that not only were they aware of lab-grown diamonds, they own or have purchased lab-grown diamonds.

Marty Hurwitz

The importance of choice. While many more high-end jewelers have embraced lab-grown diamonds and sell them alongside mined diamonds, Hurwitz acknowledges the initial resistance to the category, especially in guild stores, is still there for some jewelers. There are now an estimated 38% of independent retailers in the U.S. offering LGD in-store and/or online. Hurwitz forecasts that for this holiday season more than 50% of independent jewelers will be on board.

He reminds jewelers they’re in the love and emotions business. “It doesn’t matter what consumers have assigned that emotion to, jewelers have to make a profit on it. I’m a big proponent of offering choice. Don’t be prejudiced about going with mined or lab-grown, just offer complete disclosure without prejudice, an honest presentation of both, and go with the flow. Let the customer make the choice of what they want.”

Online shopping is growing, though still not a threat to in-store purchasing for bridal jewelry.

There are value drivers that interest both segments of consumers, he said. In MVI’s research, bridal consumers spoke up favorably for both options: some consumers want a traditional mined diamond for their engagement, and others wanted the bigger look of lab-grown for their budget.

“You do them a disservice if you don’t give them the choice,” he said.

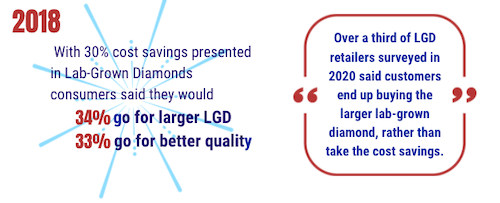

The main driver for consumers that prefer a lab-grown stone is to get a bigger look for the same money, says Hurwitz. That was a consistent finding among both all the consumers and all the retailers MVI spoke to for the survey.

“Everyone shops with a budget for bridal, and if your budget is $5,000 and you have a choice of a one-carat mined or a 1.30 carat lab-grown. Seven out of 10 customers went for the bigger stone,” he said. One carat of course is a sweet spot but in lab-grown a 1.5 – 2.0 carat is a common choice. And compared to the last study in 2018, more consumers are seeking 2.0 – 3.0 lab-grown sizes—which are actually hard to come by and more expensive, not less, than they used to be, he says.

Qualities are comparable between lab-grown and mined in bridal, he says. “Most growers can grow F, G, H color and VVS or VS goods consistently,” says Hurwitz. It’s a little harder to get D-E colors or IF goods but otherwise the qualities are consistent. Most lab-grown stones do have additional treatment, he says—they’re grown by the CVD method and then subjected to HPHT treatment to make them prettier—and that should be disclosed. But those that are original HPHT grown rarely need further treatment.

Perceived eco-friendliness of lab-grown stones resonates with consumers, says the study. Although research conducted last year debunked many of the lab-grown sector’s eco-friendly claims and the FTC has warned growers not to overstate environmental benefits in advertising, Hurwitz says it still sticks and the younger the consumer, the more significant that is as a value driver.

Related: Independent Report Finds Lab-Grown Diamonds May Use More Energy, Not Less, Than Mined

As for concerns that lab-grown diamonds don’t hold value, Hurwitz believes the sooner the industry stops talking about diamonds as investments, the better.

“We’re in the emotion business and we need to stop pitching the myth that there’s investment value in a mined diamond.”

While he makes a valid point—other than mega-stones over five carats and D flawless, most diamonds are bought at retail and sold at wholesale, says longtime industry expert Russell Shor—there is question as to what will happen to the value of lab-grown diamonds over time as production techniques are refined.

But in the shorter term, Hurwitz sees adding lab-grown stones to the merchandise mix as a win for all.

“The bigger issue as I see it for jewelry industry is that this category is capturing consumer imagination and interest. Everybody gets value out of it. The retailer gets more margin without discounting, wholesalers make more money on it. That’s value in the jewelry pipeline all the way to consumers that we haven’t seen in years.”

For better jewelers, one option may be positioning lab-grown stones as a budget-friendly entry to fine jewelry for cash-strapped consumers. If a customer has a small budget and sees that all they’re going to get for their money is a tiny chip of a mined diamond, then selling them a nicer lab-grown stone with the idea of trading up to a mined diamond when they have more money later is better than letting them walk out with nothing, says Shor, an independent consultant.

“I’m not a fan of establishing the connotation that one is better than the other, but if it helps a jeweler get the sale and that’s what they need to do, then go for it,” says Hurwitz.

The complete report, with full crosstabs, is available for download here. The report costs $125 but a special 50% discount offer is available exclusively to Centurion Newsletter readers. Enter discount code MVEYE50 at checkout.