Articles and News

Another Consumer Survey Reveals Good News For Jewelry Buying Post-COVID August 04, 2020 (0 comments)

Hong Kong—More good news for the jewelry industry: another survey shows fine jewelry continues to hold its own as a category through the COVID-19 pandemic, and that fine jewelry gifting is likely to increase in the coming months. (Image: Necklaces from the Platinum Born collection.)

Platinum Guild International (PGI) on Tuesday released its latest Insight report on jewelry consumer sentiment and behavior for the four key platinum jewelry markets: the United States, Japan, China and India. The report, titled Jewellery Consumer Sentiment and Behaviour During and Post the COVID-19 Crisis, surveyed more than 4,000 jewelry consumers in the four markets and reveals key areas of opportunity for retailers to focus on. They are: precious jewelry gifting in all markets, plus self-purchase in China and India, and omnichannel options.

In early May, the survey interviewed over 1,000 jewelry buyers and wearers in each of the four key markets. The survey focuses on three areas: jewelry-specific sentiment; general consumer attitudes and behaviors both in the COVID-19 crisis and in the near future; and the impact of COVID-19 on everyday life, relationships, and expectations for economic recovery and jewelry consumption.

The report shows that personal meaning is the most crucial driver in all four markets. Consumers view acquiring and wearing pieces of fine jewelry as a symbol of their affection for their loved ones, and bonds formed in those relationships. These findings mirror similar results in a recent De Beers study about Post-COVID attitudes toward diamonds and diamond jewelry. Like diamonds, consumers also regard platinum jewelry in particular as an expression of love and meaning, as they seek to reaffirm their relationships following a long period of anxiety.

Related: De Beers Group Diamond Insight Report Ready for Free Download

Jewelers need to know that consumers are willing to shop for jewelry—but pieces need to have meaning, says Huw Daniel, CEO of PGI. “In order to capture the potential for post-COVID-19 gifting, jewelers need to upgrade online and offline omnichannel strategy to better meet consumer needs post-Covid-19. Consumers want to see products inside the store, but with restrictions it’s important to engage with customers more proactively through online channels in the meantime,” he stresses.

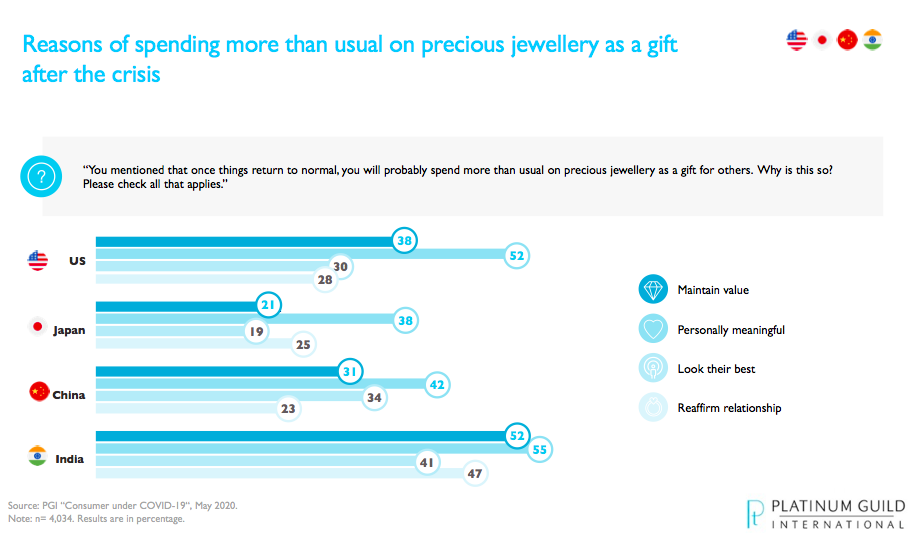

Jewelry gifting likely to increase. Jewelry pieces that are personally meaningful and will maintain value long-term are the key drivers among consumers in all four key markets, who indicated they intend to spend more than usual on jewelry for themselves after the crisis ends.

Personal meaning is the most important reason in the United States and Japan, whereas maintaining value is slightly more important in emerging markets. This emotional connection comes at a time when consumers are re-evaluating their personal lives and relationships, giving jewelry the potential to become a net winner in luxury spending during and after the COVID-19 crisis period.

Over 80% of respondents in China intend to purchase jewelry both for themselves and as gifts after COVID-19, much higher than the levels in the other three markets. In the U.S. and Japanese markets, consumers appear more willing to spend on precious jewelry as a gift post-crisis than for themselves, and jewelry has high potential to win luxury dollars in China and India.

The survey compares consumers’ willingness to spend more or same on various luxury items during COVID-19 with those willing to spend less. It indicates a willingness by consumers in the United States, China, and India to spend more on at least one luxury item during the pandemic. The results are especially notable in China, where consumers expressed a willingness to spend more on 10 luxury categories.

Globally, Chinese and Indian buyers represent the two most promising markets for near-term jewelry sales, with China, especially, already experiencing a V-shaped recovery in the jewelry market. In both cultures, jewelry is both a store of value and a marker of milestones in life.

Bricks vs. clicks. With most consumers largely shut-in at home due to government measures to control the pandemic, shopping in physical stores decreased heavily in all countries. Consumers in the United States, China, and India all reported an intention to increase their online jewelry purchases during COVID-19 compared to before the crisis. Despite a surging trend of online shopping, however, over 70% of surveyed consumers in all four markets will still consider visiting a jewelry store once it is allowed, which suggests that “online-only” would not be enough for a majority of precious jewelry consumers.

At this time, with many consumers re-evaluating their priorities in life and gaining a renewed appreciation for loved ones and spending on products that represent personal meaning as a key expression of their feelings, an integrated omnichannel strategy is needed to best target and engage consumers and improve sales conversion through multiple touchpoints.

Platinum jewelry has an opportunity to gain a larger share of discretionary purchases that can retain value and meaning if manufacturers and retailers continue to prioritize new collections and design directions to meet changing consumer needs, says PGI. PGI-USA, meanwhile, has commissioned a U.S.-specific study, the results of which will be released in the coming weeks.