Articles and News

Diamond News: White, Fancy Color Prices Both Edging Up; DPA Approves CIBJO Diamond Terminology February 07, 2018 (0 comments)

Both White And Fancy Color Diamond Prices Are Edging Up

New York, NY--Diamond market sentiment improved markedly in January, with firm prices after retailers reported a better-than-expected holiday season. The latest figures from Rapaport suggest suppliers are gaining confidence about first-quarter orders as jewelers start to replenish stock after holiday sales. Established high-end jewelers such as Tiffany & Co., Bvlgari, Cartier, and Van Cleef & Arpels had a strong holiday season, as did independent retailers. Overall, jewelers also had more effective omnichannel execution than in previous years.

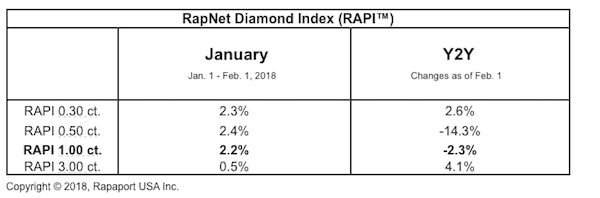

The RapNet Diamond Index (RAPI) for one-carat diamonds rose 2.2% during January, although prices still are down 2.3% from a year ago. RAPI for 0.30-carat diamonds increased 2.3%, while 0.50-carat stones gained 2.4%. RAPI for 3-carat diamonds edged up 0.5%.

Diamond trading was steady throughout the month, with suppliers filling specific requests as they waited for post-holiday inventory orders from retailers. Chinese dealer demand slowed as store owners completed their buying and focused on selling stock to consumers for the Chinese New Year, which begins on February 16. Indian manufacturers are raising their polished production after operating at reduced levels since the November Diwali break.

Dealer inventory is relatively low, with the number of unique diamonds listed on RapNet having risen just 1% during the month to 1.19 million as of February 1 – 6% below the number of listings a year earlier.

Rough trading remains robust as manufacturers ramp up production. De Beers sold $665 million worth of goods in January, with boxes going for an estimated 6% average premium on the secondary market.

Profit margins are expanding. However, rough prices are expected to rise in the coming months as miners seek to resume growth in an improving polished market, particularly after last year’s sales declines. Positive consumer spending in the US and China is likely to support polished prices, and continues to fuel optimism for 2018.

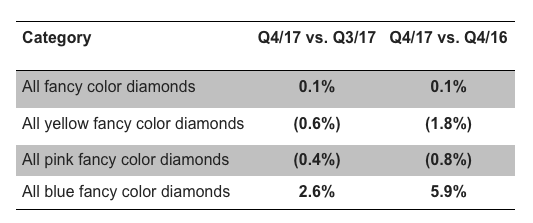

Separately, the Fancy Color Diamond Price Index edged up slightly in Q4 2017 over Q3. The Fancy Color Research Foundation (FCRF) reports significant increases in prices of fancy blue diamonds, offset by continued softness in fancy yellow diamonds, and stagnation in fancy pink diamond prices.

Yellow diamond prices continue to soften, blue prices are up sharply, and pinks are relatively stable.

The Fancy Color Diamond Index for Q4 2017 edged up 0.1% over Q3 2017 for fancy yellow, pink and blue diamonds in all sizes and saturations. Continuing the trend throughout 2017, prices of fancy blue color diamonds in Q4 increased 2.6%, with fancy intense and fancy vivid blues performing best, especially in the one and five carat categories. During the same period, fancy pink and yellow diamond prices declined slightly by 0.4% and 0.6%, respectively. For the fancy yellow color category, the overall 2017 results indicate stabilization following a 2016 decline of 4.0%.

Year-on-year compared to Q4 2016, the Fancy Color Diamond Index edged up 0.1%, with fancy blue prices up 5.9% and fancy yellow and pink prices down by 1.8% and 0.8%, respectively. In Q4, white diamonds performed relatively better than fancy colored diamonds, with the RAPI showing prices of 0.3 ct., 0.5 ct. and 1.0 ct. diamonds rising in December 2017 over the first three quarters of 2017.

Chart source: Fancy Color Research Foundation

FCRF Advisory Board chairman Eden Rachminov said, “We are seeing a stagnant supply picture of important pink and blue fancy color diamonds. Rare pinks and blues are very hard to come by and continue to command significant premiums. After more than 18 months, we are starting to see some price stability in commercial yellow fancy color diamonds, in line with the performance of white diamonds, driven by lower availability.”

The Fancy Color Diamond Index is published by the non-profit Fancy Color Research Foundation (FCRF), and tracks pricing data for yellow, pink and blue fancy color diamonds in three key global trading centers – Hong Kong, New York and Tel Aviv. For a complete data analysis, please visit www.fcresearch.org.

Diamond Producers Association Supports CIBJO Terminology For Natural And Synthetic Diamonds

Antwerp, Belgium—The Diamond Producers Association (DPA) fully endorses the Diamond Terminology Guideline recently presented by CIBJO, the World Jewellery Federation. The Diamond Terminology Guideline was developed by nine of the leading diamond industry organisations (AWDC, CIBJO, DPA, GJEPC, IDI, IDMA, USJC, WDC and WFDB) to encourage full, fair, consistent, and effective use of a clear and accessible terminology for diamonds and synthetics diamonds by all sector bodies, organisations, traders and retailers.

DPA chairman Stephen Lussier said, “The Diamond Producers Association fully supports the introduction of the Diamond Terminology Guideline. Consumers’ ability to trust the integrity of our product is directly connected to their desire for diamonds. Through accessible and unambiguous language throughout the supply chain, we will protect consumer confidence and reduce the potential for confusion.”

DPA CEO Jean-Marc Lieberherr added, “Ever greater industry alignment and collaboration is central to the success of our sector. The Diamond Terminology Guideline is a great illustration of how such a collaboration can bring clarity and transparency to the diamond pipeline.”

For further queries, please contact Sarah Gorvitz at info@diamondproducers.com. Click here to read an accompanying story about the Centurion Show panel on synthetic diamonds.