Articles and News

The Experts Predicted Crazy Prices For Gold By Now. What Happened? December 02, 2020 (0 comments)

New York, NY—Back in the spring—which in 2020 seems like a century ago—gold market analysts were certain the metal would breach $2,200 an ounce by year’s end at the very least, and many were throwing around numbers like $4,000, $5,000, and even $10,000 an ounce within a few years. With everything so uncertain, it suddenly didn’t seem that strange. After all, gold is the ultimate safe-haven asset.

Related: $2,200 Gold Sounds Scary? Experts Are Talking About $4,000 and $5,000

At first, gold stayed quiet as the coronavirus pandemic wreaked havoc on the global economy. At a time when, in theory, gold should have been rocketing, it wasn’t. In fact, in the earliest days after the World Health Organization declared COVID-19 a pandemic and the stock market was plummeting so fast that trading was halted on multiple occasions, gold also dropped back from $1,700 to below $1500—the exact opposite of what one would expect in such a situation.

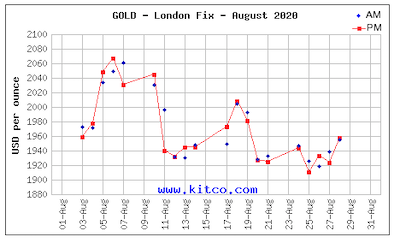

Soon, however, gold started climbing. By early July, it breached $1,800 an ounce—then an important mental milestone for investors. Three weeks later, it topped its prior record high of $1,920, set in 2011, and kept on climbing. That’s when investors really started throwing stratospheric numbers around, and gold set its new record high of about $2,067 on August 6. But then it fell back sharply to $1,940 on August 11 and, from there, it’s gone up a little and down a little, but overall has gone steadily down. Since its record-setting day, gold only broke $2,000 one more time in 2020 (so far), on August 18, when it was trading roughly between $2,000 and $2,010.

This snapshot from Kitco.com's historic price charts shows gold's peak of $2,067 on August 6. Since then, the price has retreated. It's had some brief rallies, but the overall price trend has gone down.

So here we are, a month out from the end of this most unusual year, and where is gold? Roughly about $1,810. And possibly heading down to about $1,750 or even $1700 before analysts think it will turn around and begin to gain again. In other words, not only below its prior record but only about $200 higher than it was in January of this year, showing that at least in gold terms, 2020 will go down in history as a harrowing year but not a price tag.