Articles and News

The Top Five Retail Jewelry Trends Impacting Better Jewelers In 2018 | January 10, 2018 (1 comment)

Merrick, NY—What’s the New Year without resolutions, awards shows (click here for Golden Globes coverage) and prediction lists?

Many experts have weighed in with thoughts about the most important retail trends for 2018. The Centurion looks at some of these, and below that is our own list of what will impact luxury jewelers the most.

In 2017, many retailers (Sears/K-mart, Macy’s, JC Penney, The Limited, and others) shrank doors or turned over the C-suite (Tiffany, Sterling, Kohl’s, and Neiman Marcus), but Forbes says that if 2017 was the year of retail apocalypse, then 2018 should be the start of a retail renaissance. Retailers that survived should be positioned to grow and thrive. Technology will be the driver, with artificial intelligence (AI) leading the way—assuming retailers stay on the right side of line between personalized and creepy.

2018 will be a good year for independent retailers on more than one level. The economy should remain strong and consumers confident. Meanwhile, Pamela Danziger, president of Unity Marketing, a luxury research firm, told Forbes "Shoppers will return to Main Street in 2018, fueling the highest-potential and highest-spending customers’ passion for a new shopping experience they can’t find online, at the mall, in national chains or big box stores. Owners of small retail shops feel overwhelmed by the rapidly changing techno-powered competition, especially Amazon. But small retailers have a competitive advantage: their personal touch, not just through personal service but by being vital members of the local community. This trend will reshape the retail landscape over the next decade."

Other predictions from Forbes: the rise of Bitcoin and cryptocurrency, and consumer omni-channel expectations means logistics rise to critical importance.

For jewelers, 2016’s record number of store closings slowed in 2017, but as National Jeweler’s Michelle Graff writes in her list of predictions, it doesn’t mean we’re going to see the industry suddenly start a growth track. Demographics still are what they are—an aging industry—and new stores didn’t make up for all the closed doors, but the initial wave of retirements leveled off a bit. JCK's Rob Bates lists his annual 2017 store-closing list here.

Graff also addressed some broader retail trends, such as the demise of lower-end malls and the rise of “clicks to bricks.” But in an interview with Retail Dive, Matthew Shay, head of the National Retail Federation, said retail itself is healthy, it’s just different and no matter how much disruption there is, the basics don’t change: “Ultimately it is still about what it's always been about, which is what is the customer experience and how do they get more of what they want, when they want it, how they want it, at the right price, with the right selection, or with the right exclusivity or the right level of convenience or service for your customers.”

Based on research and analysis of these and other trends, below are my top five picks for the jewelry and retail trends that will matter most to upscale jewelers in 2018:

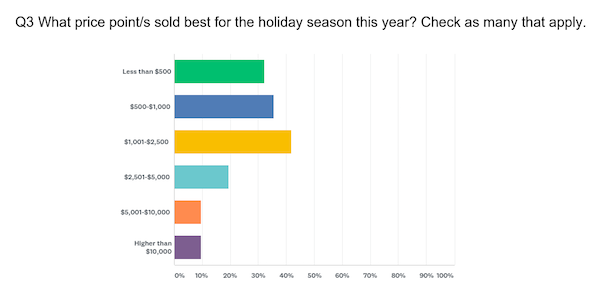

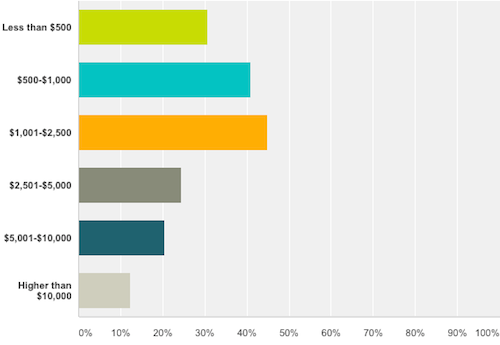

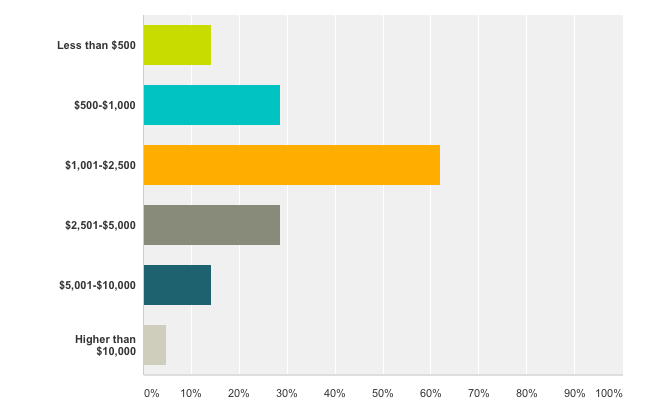

1) Better jewelers’ key sweet-spot price points remain below $2,500. For three of the past four holiday seasons—2014 through 2017—most respondents to The Centurion Holiday Sales Success Index surveys reported their best-selling price points were between $1,001 and $2,500. The second-most popular price category was goods between $500 and $1,000 and, in very close third place, goods under $500. Only 2016 saw a spike in sales of goods between $2,501 and $5,000—but with a corresponding spike in goods under $500—before returning to patterns more consistent with other recent years.

Better jewelers' top-selling price points for the holiday season in 2017 (top), 2015 (middle) and 2014 (bottom) show greater strength in the under $2,500 category than over:

2) Casual dress and female self-purchase support those price points. Those prices are consistent with strong female self-purchase patterns, as they sit in the same space as better handbags and shoes. A $95,000 canary diamond may still be a special milestone purchase, but the repeated seasonal fashion updates a woman buys for herself are mentally viewed as accessories—just like bags and shoes—and therefore are likely to be in the price space of bags and shoes. And when even De Beers acknowledges the importance of female self-purchase, it’s (finally!) officially an important category.

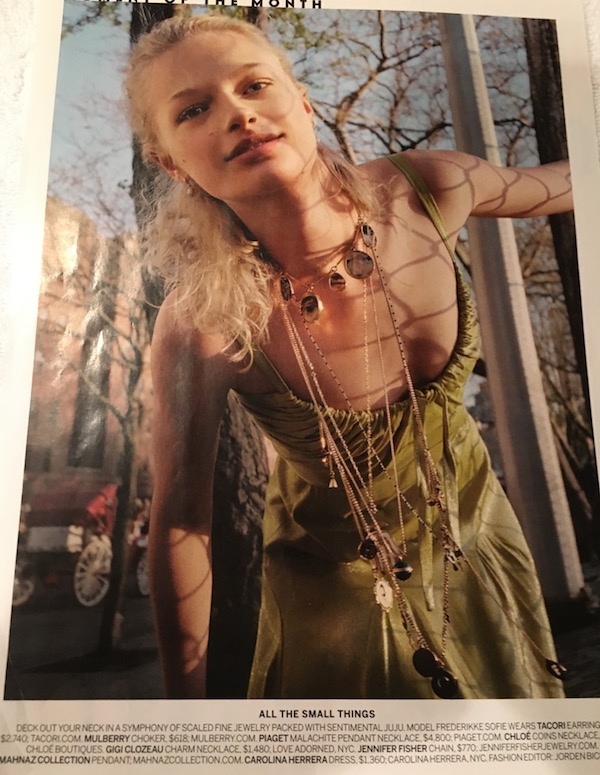

Both customers and jewelers are increasingly looking for jewelry that can be worn with casual clothes (top image, actress Jennifer Lawrence wears jeans and a T-shirt with her jewelry in an ad for Dior) and even workout gear, as evidenced by discussions during the Las Vegas shows and the brands and styles that jewelers cited as best sellers for holiday (diamond stud earrings led the pack). Based on initial trends from the Golden Globes, it looks like long delicate layered necklaces will continue their popularity. While they were executed in diamonds and/or emeralds to fill in a plunging neckline at the Globes, on a day-to-day basis delicate long necklaces are a very casual-friendly trend.

Long delicate layered necklaces will remain on-trend and a key look for jewelry in 2018. Page, Harpers' Bazaar.

Color notes: between Pantone’s “Ultraviolet” color of the year and the proliferation of emeralds and sapphires at the Golden Globes, look for green/black, green/blue, and purple to be important color combos this year. The Art Deco-influenced pieces at the globes, along with the green/black combo could be a subconscious reference to the Roaring 20s.

Above, Issa Rae and Zoe Saldana at the Golden Globes, both wearing emeralds with their black dresses. Below, "Ultra Violet" is Pantone's 2018 Color Of The Year.

3) Synthetic diamonds will get bigger, both in size and market share. As technology advances, expect the ability to grow larger and larger stones of better and better quality for lower and lower cost. The number of companies both making them and using them is likely to increase—with the deep-pocketed ones like Diamond Foundry likely to increase their marketing budgets.

This also means that crooks also will get more creative in trying to pass them off as naturals. Look for more attempts to inscribe them with fraudulent report numbers and other ways to slip them past unsuspecting buyers. Labs continue to stay one jump ahead (for now) but it will require tighter vigilance all the way up the supply chain starting with the retailer.

Only a very sharp-eyed observer will notice the difference in font that marks this falsely-identified synthetic as bogus.

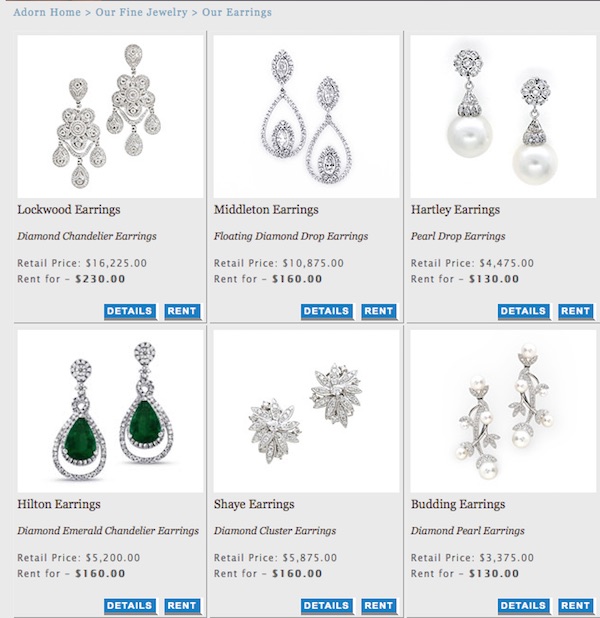

4) The secondhand and sharing/rental economy keeps growing. Pre-owned goods are now cool and chic: consumers love the idea of recycling and repurposing, with the added benefit of participating in the luxury market for far less money. Sites like TrueFacet, The RealReal (which just opened its first brick-and-mortar location), and other vetted second-hand luxury outlets are proliferating and advertising like crazy online. So are sharing sites like Adorn.com or Rent The Runway where consumers can participate in the luxury market for (almost) pennies by renting a luxury bauble, gown, or bag for a special event, then returning it. Brides that don’t have Kate Middleton’s wedding budget can borrow floating diamond drop earrings similar to hers: Adorn.com’s “Middleton” earrings (below top center) are listed for a $10,875 retail price, but a two-day rental is just $160.

5) Gray market luxury also keeps thriving. Whether through Amazon, eBay, Chrono24, or any of the above-mentioned secondhand sites, there’s no shortage of authentic, if diverted, luxury watches and jewelry online for less. Nor is there a shortage of consumers who love a bargain on luxury, and in today’s global economy a slowdown in one part of the world can mean a flood of luxury goods being liquidated in another.

A corollary to this trend is the explosive growth of low-overhead online luxury brands like Everlane (clothing), Brooklinen (bedding), M. Gemi (shoes), and so forth. Look for this category to keep expanding and start adding bricks to clicks, such as Casper, the mattress brand, is doing. The brand recently opened an outpost in the behemoth King of Prussia Mall outside Philadelphia.

Will this trend cross into fine jewelry? In my opinion, both yes and no. Because fine jewelry originally was and largely still is private label, this isn’t a new concept for our industry. But consumers are noticing the availability of high design and high quality without the high marketing overhead in the other categories and they're going to seek the same price-to-value justification for their fine jewelry purchases.