Articles and News

Gold Analyst Says Skies Are Sunny Now But Clouds Are Building | April 18, 2018 (0 comments)

New York, NY—There’s a lot of good news for luxury jewelers right now: the U.S. economy is strong, luxury jewelers had an excellent holiday season, businesses feel positive about the recent tax cuts, and gold prices have been relatively stable. Laissez le bon temps rouler.

But how long will the good times roll? In a presentation titled “Valuing Gold in An Age Of Uncertainty,” Jeffrey Christian (left), founder and managing director of the CPM Group, a commodities consultancy and research firm, advises a dose of caution.

Speaking at the last week’s “Gold: Vortex, Virtues, and Values” conference sponsored by Initiatives in Art and Culture, Christian questioned if we are in fact living in an age of uncertainty.

“We have sunny skies now, but I can see clouds on the horizon,” Christian said. The economy is strong, but he is seeing some signs of weakness.

“There’s 100% certainty there will be a recession, but the question is when, how deep, and how broad,” Christian told the audience. “We have a recession built into our economic model in 2019, relatively short and shallow. But we expect a much bigger recession built into our longer-term projections, probably around 2023 or 2024. We haven’t built it into the model yet, but we do think there will be volatility.”

Related: Leading Economists Predict A Strong 2018

What’s driving Christian’s concerns for the longer term are structural, political, monetary, labor, and financial issues around the world that have not been resolved—and that look seemingly intractable given political leadership, not just in the United States but all around the world. (Read additional economists' thoughts here, here, here, and here.)

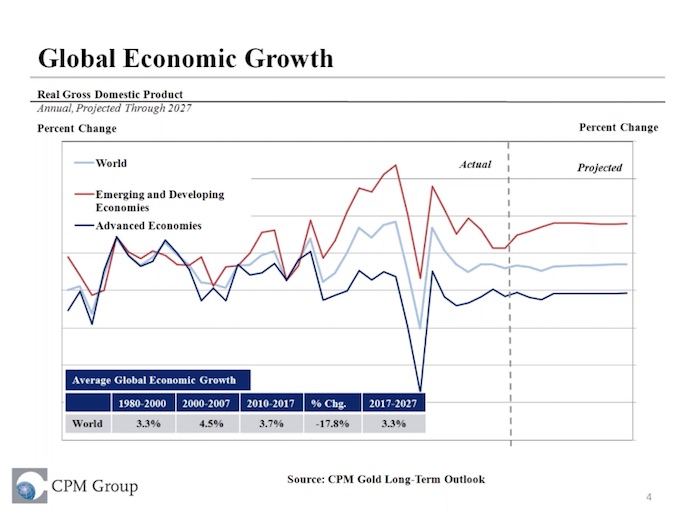

From 1980 to about 2000, the global economy was bouncing along at a 3.3% growth rate, which Christian says is the sweet spot where everything positive happens. Anything below or above signals trouble.

“From 2000 to 2007, growth overheated to 4% - 4.5% on global basis. Imbalances built up way too rapidly, leading to Great Recession and the global financial crisis,” explained Christian. “From 2010 to 2017, we saw growth at 3.7% rate, which was down sharply from the high—18% slower growth than the early 00’s—but still high.” CPM’s expectation now is for the sought-after 3.3%, but Christian acknowledges it’s probably too optimistic—which is why CPM has built a shallow 2019 recession into its model.

Christian explained that any political rhetoric about growing our way out of debt or deficit at 4%, 5% or 6%, is not realistic—no matter which side promises it. “We could have that kind of growth in the mid-20th century because the United States was producing 45% of the world’s GDP while everybody else was still rebuilding after WWII. That’s not the situation now, and it’s not going to happen again,” he said.

What is happening worldwide, however, are too many surpluses in the global economy.

“We have excess labor, not only in the United States but everywhere, and it’s only going to get worse because of computerized manufacturing and computerized services. In addition, we have excess commercial real estate, excess retail, and excess manufacturing capacity on a global basis.

“People say America doesn’t build anything anymore. The U.S. manufacturing output is almost double what it was in the 1980s, but the number of people employed making that stuff is off about 40%. People talk about the United States losing jobs to overseas manufacturing, but we lost more jobs to computers than to overseas manufacturing,” said Christian.

Where a dozen people might have been employed making something in the 1960s, 1970s, and 1980s, by the early ‘00s it went down to three people running four machines, and now it’s one person running a dozen or more machines, he said.

“Take one manufacturer making little things for hearing aids. People worked eight hours a day making these things. They replaced all those people with one 3-D printer, which works 24 hours a day and makes the things better, with a lower rejection rate.” Those are long term problems that Christian fears will come home to roost with a ferocity beyond what 2009 brought.

As for gold’s role, he reminded the audience that it is a unique asset that is woven into our culture and our psyche worldwide.

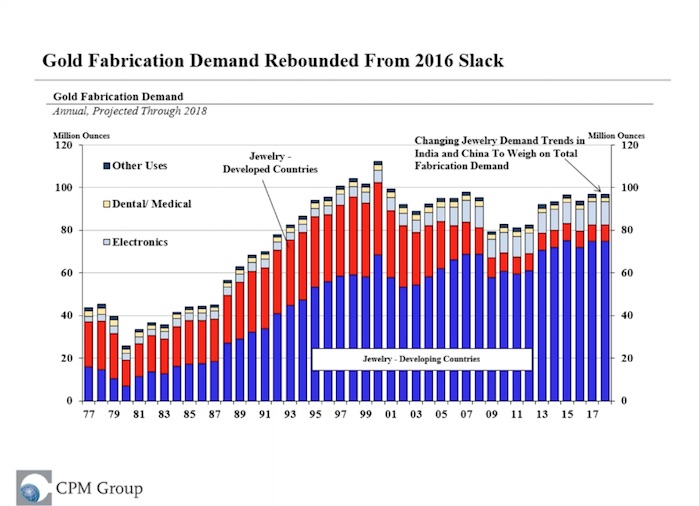

The bulk of gold used lies in jewelry. A small fraction is used in medical and technology advances, and of course as a quasi-currency and financial instrument, but 85% of gold produced either by scrap or new mines every year is used in jewelry. 88% of all gold mined throughout history is probably accounted for, in either in government or private reserves or in jewelry. Compare that with, say, copper, where only about 5% of the copper ever mined is identifiable today.

Some potential headwinds facing jewelry growth: Jewelry demand is tied to income growth and while the global economy has been holding up well, it hasn't translated into significant improvements in wage growth. That, plus shifts in consumer spending patterns, weigh on jewelry demand.

Related: After Flat Year, Gold Poised For Volatility; Jewelry Demand Up

Investors typically buy gold for one of two reasons, fear or greed, says Christian. The number of people buying it out of fear has declined, while those buying it for capital appreciation (i.e. greed) has increased.

Indians, for example, traditionally buy out of fear, so Indian demand is down as they’re less fearful as their political and banking system grows more stable. China, however, is a greed market, so when the price of gold fell in 2013, the Chinese bought a lot of gold.

Christian also touched briefly on platinum, which he says is weak and down at present but CPM expects it to rise sharply for a short time.

“Platinum is an industrial metal, not an investment metal. 60% is used in autocatalysts, especially diesel. But the world is moving away from diesel, so fewer ounces are needed there.” But the platinum industry in South Africa poorly managed itself, spending way too much on capital expansions and not enough on producing cheaply, said Christian, and that mismanagement is going to catch up and drive a 10% to 20% rise over the next decade as the world needs more platinum than what’s being mined. But longer term, it will go back down, especially depending on automotive technology.

Christian closed by reassuring the audience there will always be enough gold. He’s not a believer in “peak gold,” and he is a huge proponent of recycling and “green gold.”

“We will see more gold recovered from scrap for a variety of reasons: economic, more jewelry out there being recycled, and legislation requiring end-of-life electronics to be recycled.” As for what’s in the earth, there are huge tracts of land in both Russia and China that are filled with gold; the only question is how economically viable it is to mine it, and that will depend on the price.