Articles and News

The Year In Review: Major Changes In The Diamond Market And Other Top News From 2019 | December 23, 2019 (1 comment)

Merrick, NY—Luxury jewelers started 2019 with a boost of optimism coming off a robust holiday season and a strong 2018 overall. For last year’s holiday season, luxury jewelers outpaced general spending by a 2:1 margin, and luxury executives in general expressed confidence coming into this year, albeit casting a wary eye on the horizon. But a study found the United States still remains the world’s largest jewelry market, with $82.5 billion in sales of jewelry and watches in 2018.

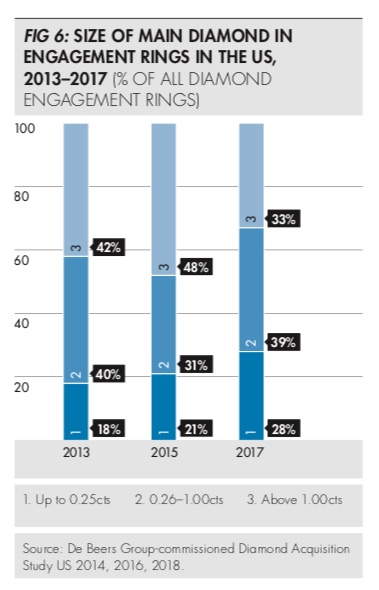

$410,000 of those sales, incidentally, came from one 10-carat ring sold at Costco, but the declining bridal market overall is causing some major shifts in how diamond marketing is targeted. Forget the “two month’s salary” idea—the average price of an engagement ring is not only going down and average stone sizes getting smaller, but a new study also shows many couples think an engagement ring should cost less than $2,500.

In response to the rise in cohabiting couples and acceptance of same-sex couples, De Beers has renamed the entire bridal category “commitment” jewelry, of which bridal is a part, not the other way around. But even without traditional marriage, couples still like the idea of giving diamonds as a gift of love. Branded diamonds are becoming more important, says De Beers’ research and, to wit, the first Forevermark branded boutique in the United States opened in November in partnership with San Francisco, CA-based Padis Jewelers.

Women figured prominently in the industry throughout 2019, starting with the appointment of Rebecca Foerster to head Alrosa’s revitalized U.S. operations. Both De Beers and the Diamond Producers’ Association dialed up their female self-purchase focus, while the Platinum Guild reported an 11% increase in sales due to female self-purchase and younger consumers.

Rebecca Foerster heads Alrosa's U.S. office.

But despite these high-profile positives, a study commissioned by the Women’s Jewelry Association found that women in the jewelry industry haven’t come quite as long a way as one might think, and that gender equality is still a major problem. It’s also an issue in lending, said Alex & Ani founder Carolyn Rafaelian, who sued Bank of America, blaming her company’s financial struggles on the bank’s refusal to lend to a female-led company.

The drive to attract Millennials continues to be a focus for jewelers, and a panel of next-gen Millennial-age independent jewelers told attendees at Centurion everything that’s on their minds and how to appeal to their peers. Millennials continue to seek more experiences and less stuff, and the industry is learning just how important it is to Millennials that their purchases do good. For example, one jeweler is busy collecting books and toys for African children.

Millennial-age jewelers Charlie Nusser, Alexis Padis, Eric Perera, and Ben Simon share what's on their minds during Centurion Scottsdale 2019.

A luxury branding consultant decoded “experience” for jewelers at the Inhorgenta Fair in Munich, Germany, explaining that the way a product is discovered and talked about can be more important than the product itself and both Alrosa and the DPA emphasized storytelling as a crucial to making Millennials desire natural diamonds.

Whether it’s driven by a lack of cash or a desire for sustainability, the sharing economy keeps growing and growing among the frugal Millennials and Gen-Z, who desire access to luxury but don’t necessarily feel a need to own it. More and more apparel companies jumping into the rental business, especially the subscription model rather than one-offs, and it opens up new opportunities for jewelers too.

Lab-grown diamonds remain a hot topic, getting hotter. The DPA, of course, is leading the charge to preserve the market for natural mined diamonds. And the Federal Trade Commission had to "re-mined” lab-grown diamond companies to watch their step in advertising. Although the natural diamond industry reacted in horror when the FTC removed the word “natural” from the definition of a diamond in 2018, the sector breathed a little easier knowing the FTC is vigilant at monitoring growers’ messaging. The DPA also shot back with its own reams of data proving that not only are lab-grown diamonds not necessarily eco-friendly, they can in fact use more energy to create than comparable natural diamonds. Meanwhile, the new Lab Grown Diamond Council trade group retained the services of SCS Global Services to create the first sustainability standard in the lab-grown diamond and jewelry market.

The Diamond Producers Association sets the story straight on sustainability in the natural diamond industry.

Lightbox celebrated its one-year anniversary in Las Vegas, garnering far less animosity than its original announcement did in 2018, and announcing the brand will be offered for sale at Bloomingdales and Reeds Jewelers. LGDs will be offered for sale at all Sterling stores, and a no-less-legendary name than Stuller launched an LGD line called Modern Brilliance.

Some pieces from Stuller's new Modern Brilliance line of lab-grown diamond jewelry.

But diamond industry gadfly Martin Rapaport isn’t quite ready to make nice: in his annual Las Vegas breakfast address he went on the warpath against lab-grown stones, saying they’ll destroy the industry and swearing off trading them or doing a price list for them. Meanwhile, prices on many natural stones continue to fall and the market is shrinking, while a 10% tariff on Chinese-produced jewelry impacts retailer margins.

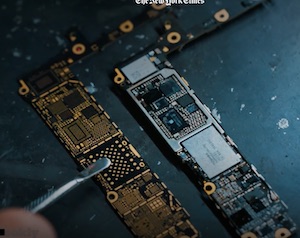

Dirty Gold. Even as the natural diamond industry struggles to seize back its narrative from lab-grown companies, troubling new issues are arising around gold. A documentary produced by The New York Times found that gold has now displaced cocaine as Colombia’s number-one criminal export. The program didn’t specifically address jewelry—in fact, cellphones were its main focus—but a week later, CNBC aired a segment on its American Greed series showing how drug money is laundered through gold, and a U.S. Treasury report charged a Middle Eastern jeweler with using gold to help fund ISIS, the global terror organization. And both programs pointed out that not only is illegal gold responsible for the same kind of violence and terror that conflict diamonds were, illegal gold mining is also poisoning the earth, something that wasn’t an issue with conflict diamonds. And with Millennials being hyper-concerned about the environment, that could spell trouble for jewelers. Meanwhile, gold hit a six-year high this fall amid global geopolitical tensions, and is predicted to hit the $2000 mark in the next two years.

A New York Times documentary found that illegally mined gold has surpassed cocaine as Colombia's top criminal export. The program focused mainly on its use in mobile phones, but jewelry is also on the radar.

Notable personnel movements: Memoire tapped Peter Smith as its new president. Former Sterling CEO Terry Burman joined diamantaire Alexander Weindling and former Alex & Ani digital VP Ryan Bonafacino as partners in Clean Origin, a lab-grown diamond company targeting Millennials and Gen-Z with bridal jewelry. Chris Croteau joined Vibhor NYC as executive vice president. Jean-Marc Lieberherr exited the Diamond Producers Association, which tapped David Kellie, a luxury fashion exec, to take his place.

Michael Pollak, CEO of the 10-store Hyde Park Jewelers chain, announced plans to step back from day-to-day responsibilities of running the business. He remains nonexecutive chairman and he and his wife, Shereen, remain the company’s sole shareholders. He called the move a “pivot, not a retirement,” as he plans to remain active with some other business projects.

Michael Pollak, who was honored by the Diamond Empowerment Fund in June, is scaling back his role at Hyde Park Jewelers.

And Joel Schechter, longtime head of Honora Pearls (now a division of Richline), retired in December.

Still struggling: The Baselworld fair, under new leadership after losing more than half its exhibitors and ticking off buyers who now will do almost anything to avoid going, is trying to make amends for the tone-deaf actions of the previous management that caused the fair’s meltdown. How successful they’ll be remains to be seen: as of last spring the fair still had lost the Swatch Group for good.

Crowds like this may be a thing of the past for the Baselworld Fair unless its new leaders can turn around the missteps of the prior management.

Signet, meanwhile, seemingly can’t get out of its own way. In April, it announced a major round of layoffs as part of its so-called “Path To Brilliance” turnaround plan, then less than a week later a scathing New York Times Magazine article revealed that the retailer’s gender and sexual harassment culture went much deeper, were much farther-reaching, and lasted much longer than previously acknowledged. Also in April, Signet president Sebastian Hobbs stepped down after a lackluster 2018 holiday season and more first-quarter declines in comparable sales.

And Tiffany is still trying to regain some of its lost luster: after more sales declines during the year, the brand was acquired by luxury conglomerate LVMH in November.

Will the Tiffany Blue box become LVMH brown? Probably not. Although the French conglomerate acquired the American jewelry house in November, it is likely to keep its signature blue intact.

Lights out: 2019 again saw some big jewelry names shutter, starting with the Samuels Jewelers chain. The Gitanjali-owned chain abruptly closed all doors in February. (Speaking of Gitanjali, after a yearlong manhunt for Nirav Modi, the Indian diamantaire accused of defrauding Punjab National Bank of billions, he turned up in London living in luxury and dealing diamonds again.)

NiMo found: Nirav Modi, the Gitanjali heir diamantaire wanted for bank fraud, is caught living large in London by reporters from The Telegraph.

As part of its troubles, Signet’s footprint continued to decline. In early 2019 it announced plans to close another 150 stores on top of the 262 it already closed in the prior fiscal year, and noted B2B news site Retail Dive put it on its watch list of financially-distressed retailers with an elevated risk of bankruptcy. Blue Nile and Neiman Marcus also won unenvied places on that list.

Renowned luxury jeweler Trabert & Hoeffer closed the doors of its last remaining salon in June, ending a more than 80-year run and liquidating its high-end jewels through Chicago-based auction house Leslie Hindman.

Five successful independents decided to hang up their loupes and retire: John and Jenny Caro of Jewelry By Designs in Woodbridge, VA; Stan and Mary Sherwin of K. Jons Diamonds and Gems in Atascadero, CA; J. Dennis Petimetzas of Watchmaker’s Diamonds And Jewelry in Johnstown, PA; Jerrold and Shirley Mack of Mack & Sons, in St. George, UT, and Tom and Mary Wright of Wright’s Jewelers, in Lincoln, NE.

John and Jenny Caro are one of five high-end independent jeweler couples who decided to retire and close up shop in 2019.

Famed luxury specialty retailer Barney’s New York shuttered, but new IP owner Authentic Brands Group is reportedly planning to keep the name going with pop-up shops and online.

Finally, Australia’s Argyle mine is preparing to wind down operations, which is already driving prices of its rare pinks to the stratosphere.

The hero stones from the Argyle 2019 Pink Diamond Tender, which if not its absolute last, is going to be one of its very last.

If the lights really go out, watch out: The Jewelers’ Security Alliance warned in April and again in July that power-cutting is becoming a popular new MO for jewelry burglars and that jewelers who experience a power outage should assume they’re being targeted. In another sign of the times, JSA also released guidelines for jewelers in an active-shooter situation. But in a bit of good news, jewelry crime was down more than 25% in 2018, a credit to law enforcement and intelligence sharing. And 2019 almost made it without any jewelry-related crime deaths until a UPS driver and a bystander were killed in Florida after a jewelry store robbery gone bad earlier this month. A California jeweler also was tied up, choked, shoved into the trunk of a car and dumped in a deserted parking lot but was found alive.

Frank Ordonez, 27, was kidnapped and killed by jewelry store robbers. He was a father of two young children.

The year in weird. Let's start by talking trash. After the priceless Swedish Crown Jewels were stolen in 2018, they were found in a suburb of Stockholm, in a garbage can in a box marked “bomb.” And a jewelry box found in the trash outside a Dallas retirement home led to the arrest of a man believed to be a serial killer who killed at least 12 elderly women and stole their jewelry.

A San Diego woman swallowed her 2.4 carat engagement ring in her sleep. The woman, who has a history of sleepwalking, dreamt she and her fiancé were being chased by bandits, and that he suggested she swallow the ring to keep them from stealing it. When she woke up, the ring was gone. An x-ray found it in her stomach and she underwent an upper endoscopy to retrieve it. And, hopefully, went to a sleep specialist.

A woman with a history of sleepwalking swallowed a 2.4-carat engagement ring in her sleep.

Meanwhile, a U.K. man snuck a diamond ring into about 20 photos of himself and his about-to-be-fiancée before proposing to her. Maybe she doesn’t follow him on Instagram, because for a month she didn’t even notice. But at least she did say yes.

A New York city vending machine is dispensing, among other things, a rose-cut diamond engagement ring for $800 (before tax.) The machine is at Vend in the Rockefeller Center Concourse, below the famous Christmas tree.

Finally, the latest debate in terminology like “cultured” vs. “lab grown” is coming not from the diamond sector but from the beef industry, where scientists are working on taking cells from animals and multiplying them into fleshy, edible muscle tissue in a bioreactor, as opposed to raising them the old-fashioned way on a farm.

In Memoriam: The industry lost some beloved leaders in 2019. In March, we mourned the death of the very personable, philanthropic, and innovative Pennsylvania jeweler Patrick Murphy, murdered while on vacation in New Orleans. In April, the industry was stunned again with the unexpected loss of colored gem dealer Richard C. “Dick” Greenwood, following a short illness. Greenwood was remembered by all as a voice of reason and calm, a peacemaker who could always find a productive resolution to any dispute.

Patrick Murphy, left, and Dick Greenwood, right.

Legendary diamantaire Leo Schachter, patriarch of the eponymous global diamond company, died in May at age 95. Glenn Nord, former president of GIA, and renowned Alabama retailer and longtime AGS leader Frank Bromberg both died the same week in June. Bromberg was 87; Nord was 90.

We bid a sad farewell to retail matriarch Jean Farmer of Lexington, KY-based Farmer’s Jewelers, Stuller’s “Tool Guy” Andy Kroungold, designer Robert Wander, writer Robyn Hawk, designer Katharine James, and grocery-magnate-turned-jeweler David Morrow, husband of San Juan, PR-based Reinhold Jewelers’ owner Marie-Helene Morrow. Also Dallas, TX jeweler Charles Skibell; Tulsa, OK jeweler Bruce Weber; designer Marc Cohen of New York-based JJ Marco; AGS New Mexico Guild officer and Rio Grande account rep Judy Jaramillo; pearl magnate Banice Bazar, and race car driver Philippe Charriol, founder of his eponymous cable jewelry line.

Andy Kroungold, left, and David Morrow, right.

We also lost designer Karl Lagerfeld, WJA legend Billie Sutter; Guido Belluzzi, a longtime goldsmith at Alex Sepkus; Marvin Zale, former vice chairman of Zales; and retailers Paul Fisher, H. Olin Peets, Arnold Bockstruck, Richard J. Scroggins, Judy Olsen, Blake Nordstrom, and traveling sales rep Michael Goldhagen.